Hemispheres Investment Management’s Premier Global Value Opportunities Portfolio features a concentrated portfolio of undervalued stocks that have underperformed major indices over the past year. The high-conviction basket of selected stocks offers investors the opportunity to own companies with compelling valuations. These carefully selected under-performing equities are either market leaders or higher quality companies. The portfolio leverages Hemispheres’ global investing expertise and experience that has historically provided investors with significant above-benchmark returns. Michael Hart and Rebecca Holden are the seasoned professionals managing the portfolio. The concentrated portfolio expects to earn a significant return if the stocks re-rate to their assessed fair-market-value.

Hemispheres Investment Management

Hemispheres Investment Management

About the Investment Managers

Michael Hart CFA, CEO of Hemispheres Investment Management, has over 35 years of investment experience. Michael was a portfolio manager and analyst for global, international and emerging market stock portfolios at Tradewinds Global Investors. He was an institutional portfolio manager and analyst of emerging market debt at Farmers Insurance Group, a large west coast insurance company. At Farmers, Michael researched and managed emerging market debt.

Rebecca Holden CFA emphasized domestic debt and equities markets during her 35 years of investment experience. Rebecca’s work experience includes commercial banking as a credit analyst, banker and manager of a large west coast bank. At Farmers Group, Inc. she was a corporate fixed income portfolio manager. At Hemispheres, Rebecca is a portfolio manager and responsible for domestic research. Michael and Rebecca have worked together at Hemispheres since 2015 and are principals of the firm.

About the Premier Global Value Opportunities Concentrated Portfolio

Premier Global Value Opportunities Portfolio (PGVOP) comprises a focused selection of 10 carefully chosen stocks. Currently, the 10 stocks in the concentrated portfolio are diversified by allocation to 7 different countries and 6 equity market sectors. Each stock represents a meaningful opportunity to earn above market returns. This approach allows for in-depth “bottom-up” analysis and a disciplined investment process. The analysis ensures that each selected company stock meets rigorous criteria for quality and potential upside.

PGVOP aims to deliver capital appreciation by leveraging market inefficiencies and focusing on high-conviction ideas. Each company position in the portfolio holds equal weight, representing about 10% of the overall portfolio. Portfolio Manager/analysts select companies for the portfolio by identifying leading, high-quality firms with discounted valuations and positive medium- to long-term fundamentals. Hemispheres’ research and portfolio management strategy differs from top-down investing that focuses on industries and the economy. The chart below lists the current aggregated valuations of the PGVOP.

Valuation Comparison of the Premier Global Value Opportunity Portfolio

| Price to Book | Dividend Yield | 12m Trailing P/E | EV/Sales | |

|---|---|---|---|---|

| HIM PGVOP | 1.36 | 2.41 | 13.20 | 0.92 |

| MSCI ACWI | 2.46 | 1.87 | 20.04 | 2.46 |

| S&P 500 | 4.63 | 1.37 | 24.20 | 3.20 |

A valuation comparison prices PGVOP at a 45% discount to the Morgan Stanley Capital International All Country World Index (MSCI ACWI) on a price-to-book basis, a 36% discount on a 12-month trailing price-to-earnings comparison, and a 63% discount on an enterprise-to-sales basis. These discounts generally stem from short-term challenges at the company. However, Hemispheres maintains a positive outlook on the companies from a medium- and long-term perspective.

Current Opportunity

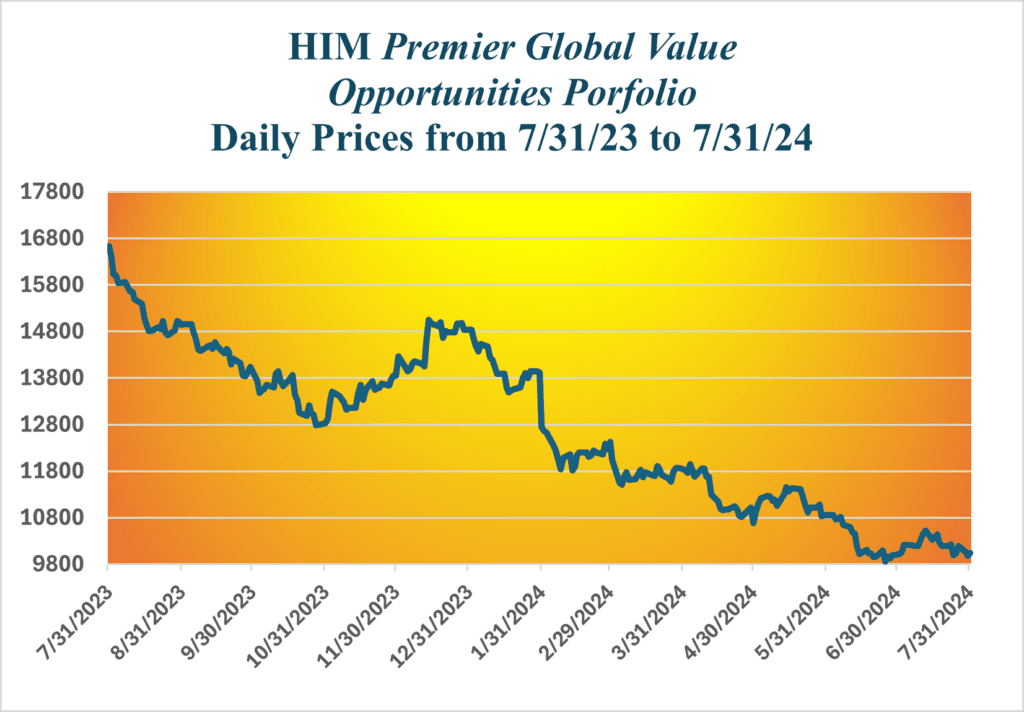

Since July 31, 2023, the stocks that currently comprise the Premier Global Value Opportunities Portfolio have significantly underperformed the MSCI All Country World Index. The return of the PGVOP during the time frame from July 31, 2023, to July 31, 2024, is -39.61%, a significant underperformance compared to the MSCI ACWI that returned +15.14% and the S&P 500 that realized a +20.34% return (please note that dividends were not included in calculating the returns). Many of the industry leading stocks in the PGVOP are priced, per Hemispheres’ analysis, at a material discount to their fair-market value, some as high as 50%.

This is an attractive opportunity for investors to put a portion of their overall portfolio to work in a select group of undervalued global equities. Given the

portfolio is concentrated, its volatility will likely be higher than a more diversified portfolio. However, one might expect higher volatility for a small and high expected return portfolio. The PGVOP should represent a small portion of an investor’s overall portfolio; investors should not view the portfolio in isolation but as part of a larger diversified portfolio. Please note that this portfolio is not FDIC insured and that investment in the securities that comprise the portfolio could result in a material loss of value; there is no guarantee on the return of the PGVOP.

If you are interested in investing in the PGVOP, click below to arrange a consultation.

Michael Hart, CFA

CEO and Director of International Research

Michael Hart has over 30 years of capital market experience. From 2007 to 2013, he worked as a Managing Director at Tradewinds Global Investors, where he was a global equity and emerging market equity portfolio manager and a global securities analyst. Prior to Tradewinds, Michael founded and operated Hemisphere Asset Management from 2000 to 2007; the Firm managed global equity, fixed income, and balanced accounts for individuals and institutions. From 1989 to 2000, he helped manage the investment portfolios of the Farmers Insurance Group of Companies as a Senior Portfolio Manager.

Rebecca Holden, CFA

Director of Domestic Research

Rebecca Holden has over 30 years of capital market experience. From 2003 to 2010, Rebecca was Portfolio Manager and Principal at Archer Capital Management in Los Angeles, California, managing domestic equity portfolios for individual clients. Prior to working at Archer, Rebecca was an equity analyst employed by Lehman Brothers in New York City following electric and gas utilities as well as energy companies. Before relocating to NYC, Rebecca was employed as an Intermediate Portfolio Manager for the Farmers Insurance Group of Companies as one of four corporate portfolio managers.

Rebecca was employed with prominent west coast financial institutions prior to employment on the Farmers accounts. Rebecca held positions as a credit analyst, banker structuring both private and publicly held bond issuances and later manager of one of the largest groups at the bank. In addition to the professional designations held, Rebecca has an MBA from Brigham Young University with a double emphasis in Quantitative Analysis and Finance (Investments).

Why choose us

Why choose us

Simplify Insurance Coverage Today

Another notable company is State Farm, a mutual insurance company that provides auto, home, and life insurance, as well as banking and financial services.

Project Completed Last Years

Happy Customer Worldwide

Our Member

Our Member