Our Services

Contact us

Our Services

Contact us

Our Services

Contact us

Our Services

Contact us

Our Services

Contact us

Our Services

Contact us

Our Services

Our Services

Our Services

Our Services

Our Services

Our Services

35 +

Years of Experience

Hemispheres Investment Management

Hemispheres Investment Management

Global Investment Management

Hemispheres Investment Management is a separate account manager. Unlike mutual funds where client assets are pooled, you will have your own account and a plan designed specifically to accomplish your future financial goals and objectives.

Michael Hart has over 35 years of capital market experience

Hemispheres Investment Management

Hemispheres Investment Management

Our Services

Investment Management

Hemispheres Investment Management services place institutional and individual investors on a path to meet their financial goals. The investment management concept includes financial analysis, the development of your portfolio that is consistent with your strategic plan as well as the selection and allocation of securities that our team of professionals believe will outperform the market benchmarks. The goal of investment management is to maximize returns while minimizing risk by diversifying assets across multiple asset classes and divergent markets.

Hemispheres offers clients greater diversification possibilities than most investment management firms because of Hemispheres ability and vast experience investing in global markets. Examples of asset classes include money market instruments, bonds, investment in small, midsized, or large capital stocks, investment in attractively valued growth or value type stocks.

Strategy Development

Investment strategy refers to specific investment planning that will help an investor achieve individual financial and investment goals. Each investor’s unique strategy depends on many variables which includes the time horizon. For an individual investor this often correlates with age and retirement.

Other factors might include the amount of available capital, specific financial obligations to meet liabilities or lifestyle requirements, and investor risk tolerance. A low risk tolerance could be met by allocating more of the portfolio to bonds, value stocks, and increased diversification to name a few methods. A more aggressive investor could increase the allocation to stocks and/or have a more concentrated portfolio. There are many unique requirements that we can discuss with you as we develop the appropriate strategy for you. We would add that strategy development should be reviewed frequently for any changes that emerge in your situation.

43 +

Expert Team

27 +

National Award

192 +

Project Completed

187 +

Happy Client

In the News

Source: The World Bank “Global Economic Prospects,” June 2023

Disclosure: Hemispheres Investment Management is a fee-based registered investment advisor (RIA). The firm is an independent RIA and is 100% employee owned. Hemispheres is registered in the state of California and Colorado and has a western U.S. client focus but also can and does help a limited number of clients with their investments needs in other states. All of the firms’ clients custody their investment assets at Charles Schwab & Co. Hemisphere’s investment focus is global investing in which it manages client accounts that comprise both domestic and international listed-securities. A copy of the firm’s regulatory written disclosure document is available upon request. HIM’s website is limited to the dissemination of general information pertaining to its advisory services. The publication of Hemispheres’ website on the internet should not be construed by any consumer and/or prospective client as HIM’s solicitation to effect, or attempt to effect transactions in securities, or the rendering of personalized investment advice for compensation over the internet.

Hemispheres Investment Management

Hemispheres Investment Management

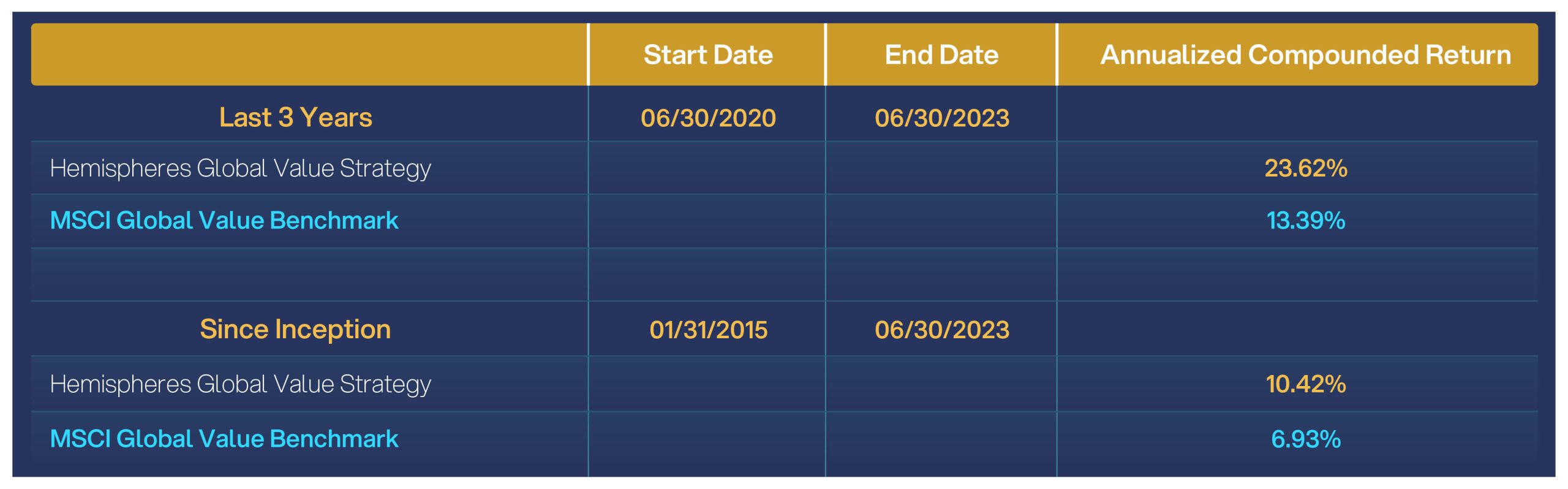

Hemispheres Composite Returns

Hemispheres Global Equity Strategy Composite Returns*

* Disclosures

- Past performance is not indicative of future performance.

- Cash was included in calculated the Global Equity portfolio returns.

- The Global Equity benchmark is the MSCI Global Value Index.

- Investing in the Global Equity risk entails substantial risks, including risks associated with investing in emerging markets.

- The Global Equity strategy is not FDIC insured and securities in the Global Equity composite could result in a material loss of value.

- Returns are time-weighted returns and were calculated using Envestnet Tamarac’s PortfolioCenter software.

- Dividends are reinvested into the strategy.

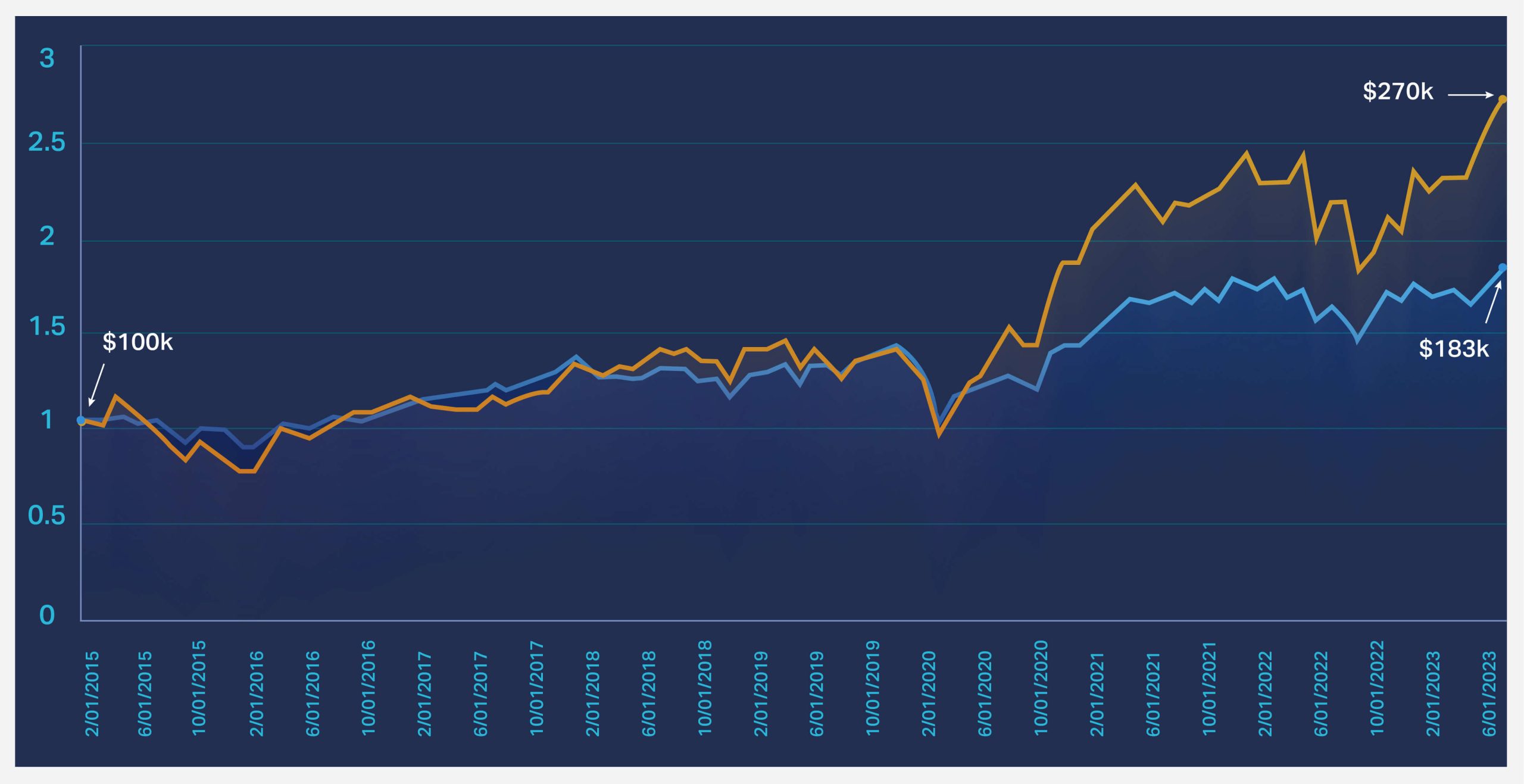

Total Returns (Value of $100k Invested @ Inception) HIM Global Equity & MSCI Global Value Benchmark 1/30/2015 to 7/31/2023

Hemispheres Investment Management

Hemispheres Investment Management

We Focus on Quality Care & Service.

Explore Hemispheres Investment Management’s expertise in Investment Management and Strategy Development. Contact us today for personalized financial solutions.

Hemispheres Investment Management

Hemispheres Investment Management

Why Choose Us

Hemispheres Investment Management offers compelling reasons to choose their investment management services:

- Expertise: A team of seasoned professionals with a track record of successful investment strategies.

- Diversification: A commitment to diversifying portfolios to manage risk effectively.

- Tailored Solutions: Customized investment plans aligned with individual financial goals.

- Risk Management: Proactive risk assessment and mitigation strategies.

- Performance: Consistent, competitive returns on investments.

Our Team Member

Our Team Member

Our Specialist

Amelia Clover

Steve Rhodes

Grace Elizabeth

Michael James

Wellness Program

Our Wellness Program offers comprehensive wellness assessments and screenings to help patients identify areas of improvement,

Wellness Program

Read MoreSpecialty Care

Our Specialty Care program provides access to top medical specialists and centers, ensuring that patients receive the highest quality,

Specialty Care

Read MoreDigital Health

Our Digital Health program provides convenient and secure virtual visits, allowing patients to receive care from the comfort of their,

Digital Health

Read MoreCost Containment

Our Cost Containment program provides transparent pricing and cost estimates, helping patients make informed healthcare decisions,

Cost Containment

Read More

Insurance Benefits

Insurance Benefits

Health Care Security Through Insurance

Health insurance policies can vary in their coverage options and costs, but they generally help individuals and families pay for medical expenses.

Life Protection

69 %Customer Service

84 % Testimonials

Testimonials

Customer Testimonials Our Insurance Coverage

Hemispheres Investment Management offers comprehensive Investment Management services, optimizing portfolios for returns and risk. Additionally, our Strategy Development services provide tailored plans, leveraging market insights and strategic analysis to achieve clients' financial objectives efficiently.

Client-Centric: Focused on the unique needs and objectives of each client.

Sara Albert

Hemispheres Investment Management guides our strategy, delivering exceptional results for our financial goals.

James Millard

As a long-term client, I attest to Hemispheres Investment's value, strategic approach, and personalized service for our success.

Richerd William

Hemispheres Investment: Tailored plan, perfect alignment with my goals, sets industry standard in client satisfaction.

Insights

Insights

News & Articles

Expert Advice for Investing in Global Equities: Why Hemisphere Investments is Your Best Partner

Introduction In today's interconnected world, investing in Global Equities offers...

Real Interest Rates

Q4 2024 Market Commentary On 9/18/2024 the Federal Reserve lowered...

The Role of Emerging Market Bonds in a Core-Plus Bond Strategy

Introduction In today's complex global economy, investors are constantly seeking...

From The Blog

From The Blog

Blog & Articles

- Rebecca Holden, CFA

Expert Advice for Investing in Global Equities: Why Hemisphere Investments is Your Best Partner

Introduction In today's interconnected world, investing in Global Equities offers...

Read More

- Michael Hart, CFA

Real Interest Rates

Q4 2024 Market Commentary On 9/18/2024 the Federal Reserve lowered...

Read More