Other Products

- Home |

- Other Products

Hemispheres Investment Management

Hemispheres Investment Management

Investment Management

Welcome to Hemispheres, your trusted partner in global investment management. At Hemispheres, we understand that navigating the complexities of the global market requires expertise, insight, and a personalized approach. We offer a comprehensive suite of investment management products and services designed to optimize your portfolio and unlock opportunities across the globe.

Products

Hemispheres Investment Management Global Equities

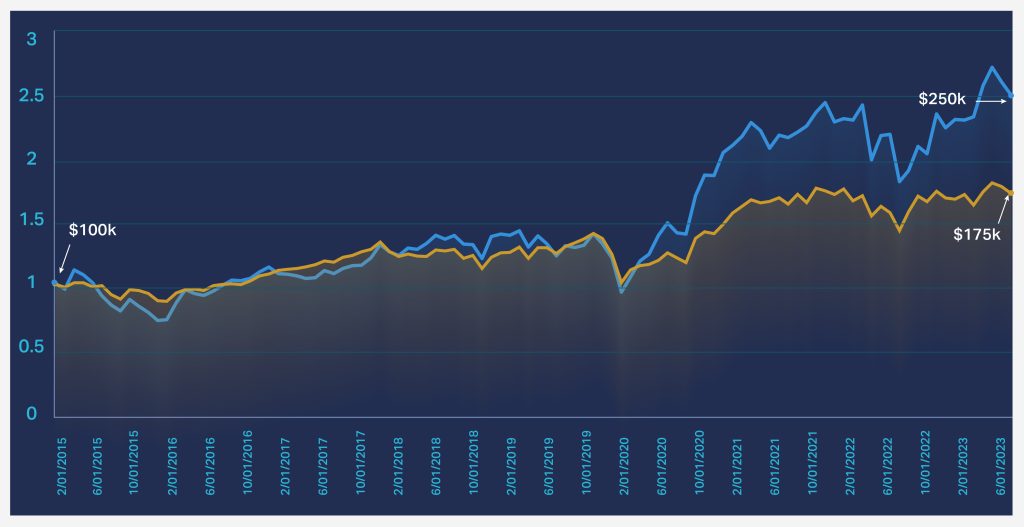

Hemispheres’ flagship investment product is its Global Equity strategy. The global equity portfolio consists of high-quality companies diversified by sector, country, and region with size limitations. Equities in the portfolio are value-oriented, high conviction companies and usually number about 45 to 50 securities in aggregate. Hemispheres commenced managing the strategy in January 2015.

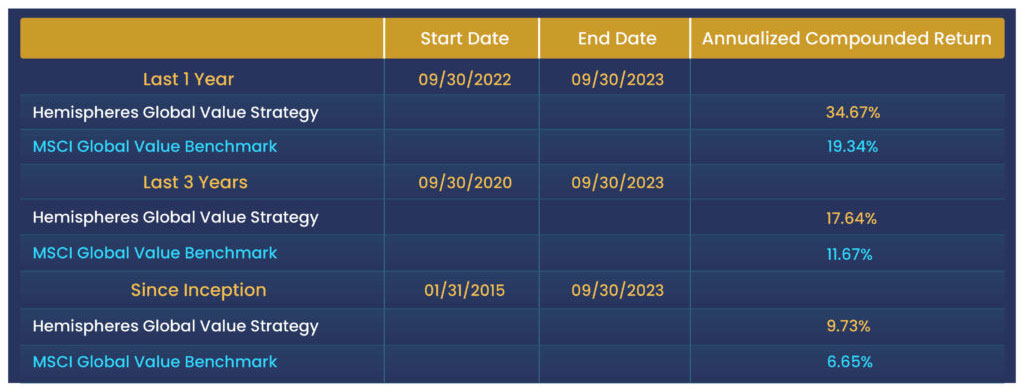

Hemispheres Global Equities Strategy (Net)

Composite Returns

Global Equities Total Return Line vs. the MSCI Global Value Benchmark

Disclosures:

⦁ Past performance is not indicative of future performance.

⦁ Cash was included in calculated the Global Equity portfolio returns.

⦁ The Global Equity benchmark is the MSCI Global Value Index.

⦁ Investing in the Global Equity risk entails substantial risks, including risks associated with investing in emerging markets.

⦁ The Global Equity strategy is not FDIC insured and securities in the Global Equity composite could result in a material loss of value.

⦁ Returns are time-weighted returns and were calculated using Envestnet Tamarac’s PortfolioCenter software.

⦁ Dividends are reinvested into the strategy.

Hemispheres Domestic-Plus Equities Strategy

A domestic portfolio consisting of Exchange Traded Funds to provide broad market exposure and selected equities that we deem compelling and undervalued.

Performance (net returns from 10/31/2022 to 12/31/2023)

Domestic-Plus Equities 28.47%

Russell 3000 Index 24.50%

Disclosures:

- Past performance is not indicative of future performance.

- The FDIC does not insure Equity investments. The Domestic-Plus Equities strategy could sustain a material loss of value.

- Portfolio returns include cash.

- The Domestic-Plus Equities benchmark is the Russell 3000 Index.

- Investing in the Hemispheres’ equity strategies entails substantial risks, including risks associated with investing in emerging markets.

- Envestnet Tamarac’s PortfolioCenter software computes the time-weighted portfolio returns.

- Strategy returns include reinvested dividends.

Hemispheres Core-Plus Bonds Portfolio

The “Core” part of the portfolio would consist of highly diversified securities such as one would find in the Bloomberg Aggregate Bond Index. The “Plus” component of the portfolio would represent strategic allocations of bonds that Hemispheres views as offering superior investment returns. When attractive valuations present, the portfolio may include global, investment-grade, below investment-grade, preferred securities and convertible bonds.

Core-Plus Bonds Annualized Composite Returns (Gross) 1/31/2015 to 12/31/2023

Hemispheres Core-Plus Bonds 2.68%

Bloomberg Investment Grade Bonds .33%

Disclosures:

⦁ Future performance may not be consistent with past performance.

⦁ Bond portfolios are not FDIC insured. Investment in Hemispheres Core-Plus Bond strategy could result in loss of value.

Cash is included in calculated portfolio returns

The Bloomberg US Aggregate index is the benchmark for the Core-Plus Bonds strategy.

⦁ The time-weighted returns and were calculated using Envestnet Tamarac’s PortfolioCenter software.

⦁ Interest income is reinvested into the strategy.

Hemispheres Investment Management

Hemispheres Investment Management

Why Choose Us

Hemispheres Investment Management offers compelling reasons to choose their investment management services:

- Expertise: A team of seasoned professionals with a track record of successful investment strategies.

- Diversification: A commitment to diversifying portfolios to manage risk effectively.

- Tailored Solutions: Customized investment plans aligned with individual financial goals.

- Risk Management: Proactive risk assessment and mitigation strategies.

- Performance: Consistent, competitive returns on investments.

Why choose us

Why choose us

Simplify Insurance Coverage Today

Another notable company is State Farm, a mutual insurance company that provides auto, home, and life insurance, as well as banking and financial services.

Project Completed Last Years

Happy Customer Worldwide

Our Member

Our Member