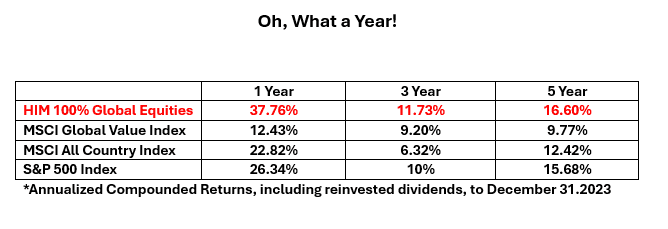

Global Equities

After a tumultuous 2022, stock and bond markets enjoyed a stellar performance year in 2023. Hemispheres equity strategies surged ahead, with its 100% global equities strategy up over 37%. For 2024, the Firm continues to own undervalued global equities, yet tempers its return expectations compared to 2023, given the upward pricing that many stocks experienced last year. For a perspective on global equities, Hemispheres remains positive because stocks continue to be priced at a material discount to their assessed fair-market value. The speed at which the Federal Reserve reduces interest rates will be a determinant in this year’s return.

Bonds

The bond market experienced one of the strongest rallies on record during Q4 2023 as the Bloomberg U.S. Aggregate, the comprehensive benchmark for the U.S. investment grade, returned 6.82%! Despite this strong performance, Hemispheres continued to stay invested in bonds as many bonds are still priced at attractive yield-levels.

Summary

Hemispheres is constructive on stocks and bonds that are held in accounts for the benefit of its clients. As always, the firm monitors global equities markets for compelling investment opportunities. It utilizes a value-based, repeatable investment process that its principals have developed and honed over their investment careers. Book a meeting

Michael Hart, CEO & CFA

Portfolio Manager & Director of International Research

310.993.1886

Rebecca Holden, CFA

Portfolio Manager & Director of Domestic Research

818.970.1197