Road Trouble Ahead

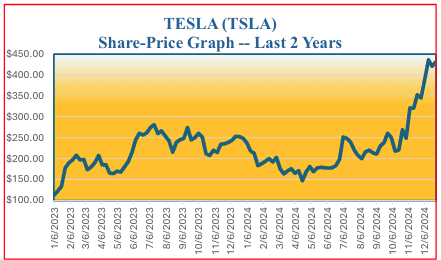

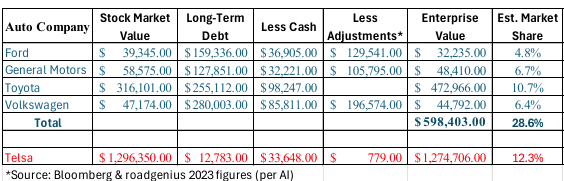

How does one spell stock market bubble –T-S-L-A. Yes, Tesla’s stock price is currently elevated to a level that is “you name it” — overdone, excessively high, nose-bleed height or just plain crazy. As one of the Magnificent 7 stocks, current shareholders of Tesla will likely experience a wrecking-crew decline in value of their Tesla related wealth. Per the table below, if one were to aggregate the stock market enterprise-value of Ford, GM, Toyota and Volkswagen, these four companies together would represent a mere 47% value of Tesla’s enterprise-value [enterprise-value is a measure of a company’s total value, including all ownership interests and asset claims from both debt and equity less the value of its cash and other adjustments].

Hemispheres asks, “Is Tesla stock worth over 2x’s the aggregated enterprise-value (the finance industry’s EV) of these four major producers of autos,” especially considering that their in-sum market share is 28.6% versus Tesla’s 12.3%? Hemispheres Investment Management’s answer is NO, especially since Tesla sold fewer cars in 2024 than it did in 2023. For further information on Tesla and electric vehicles, refer to the Hemispheres November 25, 2024 article, written by Rebecca Holden, CFA

https://hemispheresim.com/navigating-the-electric-vehicle-landscape-a-complex-road-ahead/.

Hemispheres Investment Management utilizes a “bottom-up” approach in its research and portfolio

management efforts. Instead of trying to forecast the direction of stock markets, Hemispheres focuses on the fundamentals and valuation of stock-market-listed companies. The firm focuses on purchasing companies that it assesses as significantly undervalued compared to their assessed fair-market value

(FMV). Hemispheres currently identifies numerous global stocks priced at a material discount

to their FMV.

Bonds

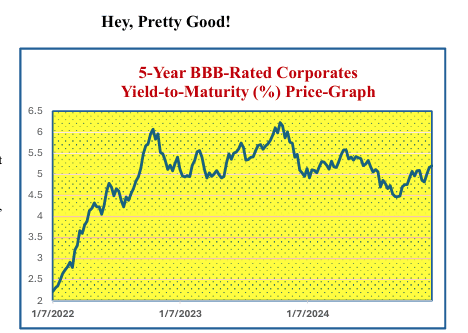

Post the low interest rates that existed in most of 2020 and 2021, 5-year BBB rated (investment grade) bonds have bounced around in a 4.5% to 6% range. At the current level of 5.2% for the BBB- rated yield composite, Hemispheres has a positive opinion toward bonds. With U.S. inflation in the 2.7% range, a real

yield (yield minus trailing 12-month inflation) in the 2.5% range is pretty attractive. Assuming another 9% inflation spike doesn’t occur—though a pronounced inflationary uptick could arise if high tariffs, substantial deficit spending, and large-scale immigrant deportations combine—owning bonds remains a recommended strategy for balanced accounts.

Michael Hart, CFA

Portfolio Manager & CEO

Rebecca Holden, CFA

Portfolio Manager & Director of Domestic Equities