Platinum Group Metals

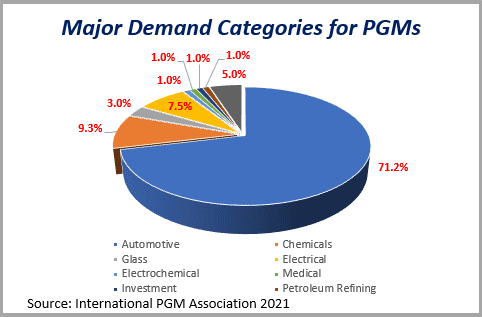

In 2021 about 71% of estimated annual Platinum Group Metal (PGM) demand comes from the motor vehicle segment of the economy. Platinum is a key component in catalytic converter manufacturing. A catalytic converter’s function is to reduce dangerous gases found in engine exhaust. Approximately 95% of vehicles have catalytic converters. Other material uses of PGM are in chemicals, glass, and electronics. Platinum is one of the rarest metals on earth. Platinum is more than 10-times rarer than gold. To mine most PGMs, producers must dig far into the earth’s crust to extract the ore body. Deep mining is much more challenging and costly compared to surface mines. Hemispheres toured a South African PGM mine and was very impressed with the mine infrastructure and the incredible glow (!) of the ore body.

Implats

Formally known as Impala Platinum Holdings Ltd, Implats (stock symbol IMPUY) operates seven PGM mines. Five of the mines are in South Africa. Holding a significant 21% market share in total platinum output, the company boasts an impressive reserve life of over 28 years at its current production rate.

In addition to its mining operations, Implats owns and operates a PGM refiner, which is in South Africa. Comparing its current balance sheet to fiscal year 2019, Implats has reduced its indebtedness by 77% and increased its cash level by 138%! Year-to-date, the price of platinum has declined by over 15%; during the same time-period, the share-price of Implats has fallen by over 66%. Implats is valued at 56% of book-value currently and a three-year average forward price/earnings ratio of 7.8x, versus 14.7x for the MSCI World Index, or a 47% discount.

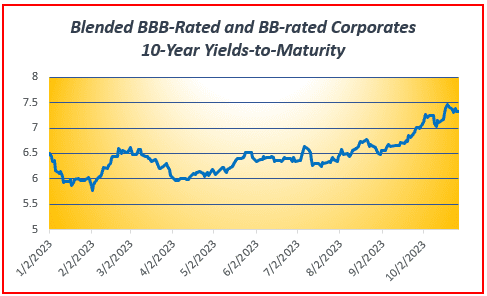

Corporate Bonds

In concert with higher U.S. Treasury yields, 10-year corporate yields are elevated. From a low of 5.77% in February 2023, the blended BBB-rated/BB-rated 10-year corporate bond yields are now approaching 7.5%. This is a very attractive level! With inflation currently measured at 3.7%, the highlighted 10-year corporate real-yields are over 3.5%. (real yields = the corporate yield minus the inflation rate). Hemispheres is bullish on bonds. Yields in the bond market are now near 20-year highs and there are plenty of bonds to choose from in building a bond portfolio.

Please contact us for a free consultation. Book a meeting

Michael Hart, CFA

(310) 993-1886

Rebecca Holden, CFA

(818) 970-1197