Q4 2024 Market Commentary

On 9/18/2024 the Federal Reserve lowered its target range for the federal funds rate by half a percentage point. The current target rate range is now 4.75% to 5%. This was the first rate reduction since March 22, 2023. The federal funds rate is the interest rate banks charge each other for overnight loans.

Although several factors influence the fed funds rate, we will analyze its historical relationship with the consumer price index and the real rate of interest.

Real Fed Funds Rates vs. Fed Funds Target Rate Historically

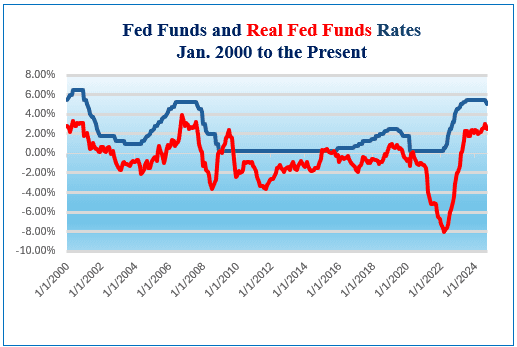

By evaluating this data, we are trying to get a picture of how much the Federal Reserve, through it’s Federal Open Market Committee (FOMC) may reduce rates, if all other factors evaluated by the FOMC remain static. We examine a 44-year monthly historical relationship between the Federal Funds Rates and Real Fed Funds Interest Rates (which is the Federal Funds Rate less CPI). Over this period, the average real interest rate is 1.13%. As of 9/30/2024, the real interest rate was 2.5%.

Looking at a more recent history, starting in January 2000 (see the chart above), the average real Fed Funds rate is -0.6%. Based upon the historical 44-year average real interest rates compared to the 9/30/2024 rate, if the other metrics evaluated by the FOMC remain stable, the Federal Reserve can easily reduce rates at least 100 basis points, or 1%. Such a rate reduction should be positive for stocks and credit sensitive securities (bonds).

The Federal Reserve Mandate

The FOMC’s 9/18/2024 statement emphasized its strong commitment to support maximum employment and return inflation to 2%. The statement indicated that the FOMC is prepared to adjust monetary policy if risks threaten its objectives. The Committee’s assessments will consider a wide range of information, including readings on labor market conditions, inflation pressures and inflation expectations, and financial and international developments.”

The Federal Reserve’s mandate is to promote maximum employment, stable prices, and moderate long-term interest rates. This means balancing economic growth with controlling inflation and ensuring a stable financial system.

Conclusion

Hemispheres Investment Management’s (HIM) team of seasoned professionals have a 35-year track-record of successful investment strategies garnered over many different economic cycles and interest rate environments. HIM’s operating performance demonstrates deep proficiency investing in US, international developed and emerging markets. We can assist you customize a portfolio to meet your individual needs as well as to diversify your investments. The Global Equities product is Hemispheres flagship product.

Please contact Hemispheres Investment Management for a free consultation. We offer customized guidance and strategies that can help you or your business meet your financial objectives. Book a Meeting