Interest Rate Policy

The Federal Reserve completed one of the most aggressive tightening of monetary policy in July of this year. The Federal Reserve adjust money policy through Interest Rate adjustments. Therefore, we thought we would analyze prior cycles to assist us in our outlook for 2024. Most economists currently are predicting a recession in 2024, although the data is pointing to a mild recession. The recession forecast is based on several factors that create downside risk to the US economy early next year.

Consumer Savings Rates and Indebtedness

Savings Rates

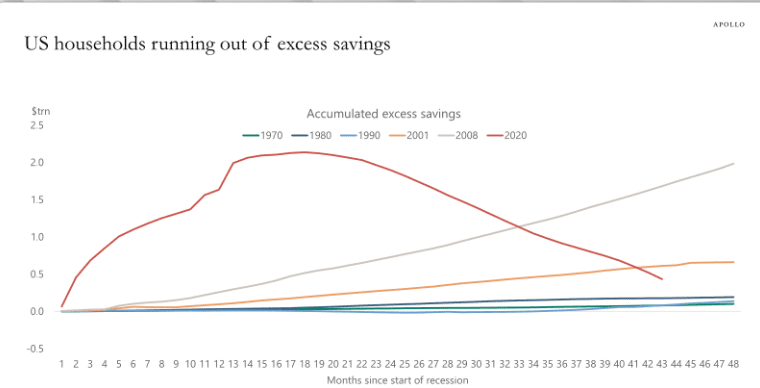

First, the savings rates of households have been declining since the March 2020 start of the Covid 19 pandemic. The rate of savings varied significantly from prior recessions as shown on the chart below. Between the pandemic related business closures and other restrictions, coupled with government stimulus, people saved because they really couldn’t spend. A surge in consumer spending followed the relaxation of restrictions resulted in a decline in savings. However, it’s crucial to highlight a significant aspect: currently only the top 20% of income earners possess excess savings. Nonetheless, this demographic contributes significantly to our economy, constituting 40% of consumer spending.

Economists estimate that within the next 3-4 months, most of the excess savings will be depleted. A reduction in consumer spending could lead to a slowdown in the economy. Additional economic risk factors include the restarting of student loan payments as of October 1, 2023. Furthermore, an estimated 44 million people carry student loans in the US. The average monthly student loan payment of approximately $300 constitutes a significant portion, about 7-10% of the average borrower’s net income.

Indebtedness

Another risk factor is indebtedness, especially those dependent upon credit card debt. Higher interest rates are causing stress and in many cases an increase in delinquencies to financial institutions. As of September, for borrowers aged 18-29 years of age, almost 10% of credit cards and approximately 5% of auto loan balances were greater than 90 days delinquent. Prior to the first Federal Reserve rate hike in March of 2022, credit card delinquencies for the 18-29 age group were about 5.5% and auto loan delinquencies were just under 3%. This financial burden could further impact consumer spending patterns and economic dynamics. Keeping a close eye on these factors will be crucial for understanding and managing potential economic challenges ahead.

Source: BEA, Haver Analytics, Apollo Chief Economist

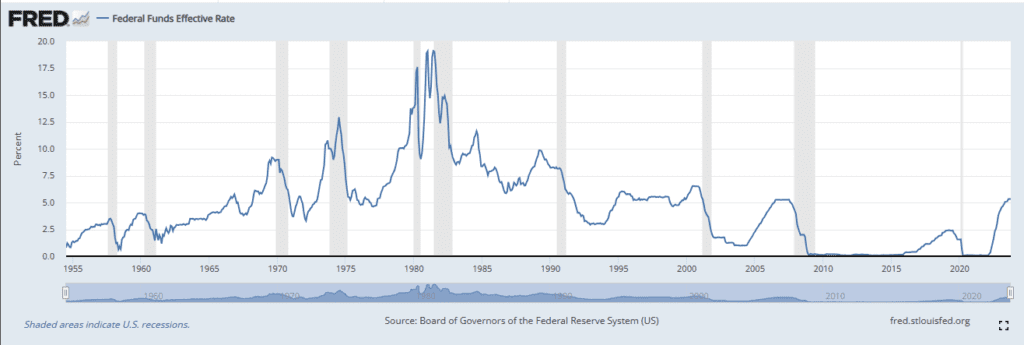

Stock Market Returns vs. Interest rate policy

Based upon forward looking data, it appears that the economy is slowing. What does any of this mean for the stock market? The chart below was generated by the Federal Reserve and shows the Federal Funds Effective Interest Rate as well as recessions reflected as vertical gray bars. A study comparing periods of rising interest rates to declining interest rates versus S&P 500 returns was enlightening. From January 1985 to September 30, 2023, the S&P yielded positive monthly returns 80.95% of the periods when rates were declining (after an interest rate top) versus a negative monthly return on the index of 19.05%.

When rates were rising (after an interest rate bottom), the S&P 500 monthly returns were positive 84.46% of the time versus negative monthly returns of 15.54%. The S&P returns were the most consistently negative in the months immediately before a recession was officially declared and the Federal Reserve shifted to an easier monetary policy. The conclusion is then that the stock market bias is to the upside, especially over long-time horizons. Short-term market timing strategies have long since been proven unreliable.

Next year is a Presidential election year. We analyzed the historical positive vs. negative return of the S&P 500 during an election year. In the previous nine Presidential elections, 81.8% of the time the S&P 500 had a positive return versus 18.2% negative. The Federal Reserve attempts to be politically neutral and therefore we will expect the Federal Reserve to lower interest rates in a timely manner to mitigate the risk of a deep recession. In the absence of any extraordinary events, it’s reasonable to anticipate a historical positive bias for 2024 stock market returns.

Conclusion

The Federal Reserve comments indicate that long-term interest rates will be higher than what we have witnessed since the 2008 financial crisis. Short-term interest rates designed to reduce inflation appear to be achieving the Federal Reserve’s goals. Because the data is supportive of this thesis, the consensus is that the Federal Reserve may be able to start cutting interest rates by April 2024. Realization of these goals by the Federal Reserve would be very supportive of equity and bond prices over the full year 2024.

You would be most welcome to reach out to us should you have any questions or comments regarding this article, or any other questions you may have. Book a meeting

November 29, 2023

Rebecca Holden, CFA

818.970.1197

Michael Hart, CFA

310.993.1886