Global Equities strategies can be actively managed through the selection of individual securities, passively through index funds, or through a combination of both to gain access to specific markets. This article discusses the concept of index funds.

Introduction to Index Funds

Key Concepts

What Are Index Funds?

An Index fund is a pooled investment vehicle where the portfolio holdings, position weightings and returns closely track a broad market index. A stakeholder would invest in an index fund either through a mutual fund or an exchange traded fund (ETF). An investor cannot directly buy the index itself. Common examples of invest-able indices include: the S&P 500 index, the Russell 2000 Index, the MSCI World Index, or the Barclays Aggregate (for bonds). There are many different funds covering a variety of different indices and asset classes.

Types of Market Indexes

Market cap-weighted indices, such as the S&P 500, allocate weight based on company size, while price-weighted indices, like the Dow Jones Industrial Average, use share prices for weighting. Each method influences index composition and performance.

The Mechanics of Index Funds

An index fund is structured to track a market index. This is achieved in different ways. Some funds invest in every security included in the specific index. Other funds invest in a representative sample of the securities that are included in the given index. A third method uses derivatives (such as options or futures contracts) to track the index.

The fundamental concept behind an index fund is that it is a passive investment strategy. The security weights in the fund match the index weights. The passive strategy is a buy and hold strategy. The funds do not attempt to anticipate which stocks or sectors will outperform the index, and the goal is to match the index return. Because there are small fees assessed by the fund, performance of the fund almost always slightly under-performs the index itself.

The Appeal of Index Funds in Global Equity Markets

Global Reach

Index ETFs and Passively managed Mutual Funds exist for most areas of the world that have invest-able markets. Hemispheres Investment Management utilizes ETFs from time to time. The ETFs are added to an actively managed portfolio to provide enhanced diversification benefits and targeted access to specific sectors or countries to enhance returns.

Cost Efficiency

Passively managed funds can have very low fees, and this is a major benefit of the approach. Passively managed funds utilize buy and hold strategy and since the funds are simply matching the index there are no research costs. Based on a March 2024 article in Forbes Advisor,[1] we gathered the statistics listed below:

| ETF Fund (Different Strategies) | Expense Ratio | 1 Year Performance |

| SPDR – S&P 500 Value (SPYV) | 0.04% | 18.89% |

| Fidelity Value Factor (FVAL) | 0.29% | 20.21% |

| Invesco FTSE RAFI Developed Markets (PXF) | 0.45% | 19.55% |

| Vanguard International High Dividend Yield (VYMI) | 0.22% | 10.85% |

| Invesco S&P Mid Cap Value with Momentum (XMVM) | 0.39% | 14.10% |

| Vanguard Mid Cap Value (VOE) | 0.07% | 06.63% |

| Vanguard Small Cap Value (VBR) | 0.07% | 12.66% |

The fees on passively managed ETFs have dropped significantly over the past 20 years. Morningstar recently wrote that fees on an asset weighted basis have declined from 91 bp to 37 bp over the 20-year period[2]. ETFs are attractive to investors because they are traded on an exchange like a stock. Many brokerage companies no longer charge commissions on trades.

According to Morningstar data, the average S&P Index mutual fund has an expense ratio of 0.79%. The average expense ratio for a developed world index excluding the US is 0.89%. For an emerging market mutual fund, the average expense ratio is 1.15%.[3] The marketing and distribution fees (12 b-1 fees) have come down sharply or have been eliminated completely as most investment managers now charge a fee based upon assets under management instead of receiving a commission from the mutual fund company.

Simplicity and Transparency

Passively managed Index ETFs and Mutual Funds are very simple and transparent. The strategy is simple because in its most basic form every stock in the index is purchased. The stock weighting in the portfolio closely, or exactly matches the index weight. The strategy involves little or no trading, there is no research. The manager is attempting to match the performance of the index as opposed to outperforming. The strategy is transparent because stocks held by an index are easily looked up online and the holdings in the investment vehicle closely match the index.

Benefits of Index Fund Investing

Diversification

Index funds inherently provide investors with diversification benefit because the fund is designed to match an index. A sector index fund, for example, would include most, if not all, of the stocks in the index. A broad market index fund would be structured to mirror the entire index, including sectors and stocks in similar weighting as the index.

Performance Consistency

A Wharton Executive Education article reported the following regarding U.S. investing only:

“Actively managed investments charge larger fees to pay for the extensive research and analysis required to beat index returns. But although many managers succeed in this goal each year, few are able to beat the markets consistently, Wharton faculty members say.

Over a recent 10-year period, active mutual fund managers’ returns trailed passive funds consistently, says Kent Smetters, professor of business economics at Wharton.

On an after-tax basis, managers of stock funds for large- and mid-sized companies produced lower returns than their index-style competitors 97% of the time, while managers of small-cap stocks trailed 77% of the time.

Passive management generally works best for easily traded, well-known holdings like stocks in large U.S. corporations, says Smetters, because so much is known about those firms that active managers are unlikely to gain any special insight.

But in certain niche markets, he adds, like emerging-market and small-company stocks, where assets are less liquid and fewer people are watching, it is possible for an active manager to spot diamonds in the rough[4].”

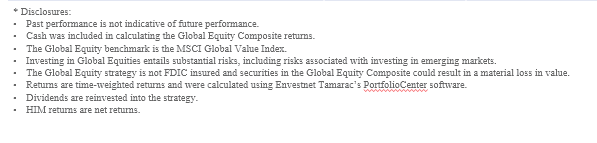

Hemispheres Investment Management is an active “value” manager. Our flagship investment product is Global Equities. This includes domestic, international developed markets as well as emerging markets. Hemispheres’ performance since inception for this product is as follows:

| Start Date | End Date | HIM Global Equities |

MSCI Global Value Index |

S&P 500 | |

| 1 Year | 12/31/2022 | 12/31/2023 | 37.76% | 13.69% | 26.26% |

| 3 Years | 12/31/2020 | 12/31/2023 | 11.73% | 9.56% | 10.00% |

| 5 Years | 12/31/2018 | 12/31/2023 | 16.60% | 10.23% | 15.68% |

| 8 Years | 12/31/2015 | 12/31/2023 | 15.22% | 8.46% | 13.22% |

| Since Inception |

1/31/2015 | 12/31/2023 | 11.29% | 7.55% | 11.80% |

Tax Efficiency: Passive investment funds are highly tax efficient because they are buy and hold strategies. Tax implications arise upon the sale of a security.

Considerations When Choosing Index Funds

Assessing Different Indexes

There are many different management companies that offer global index funds. Key points to assess include the fees charged and the length of time a portfolio manager has been managing the fund. It is important to evaluate the returns and tracking difference between the index and fund performance during the fund manager’s tenure. Of course, other critical components to assess include whether the fund meets investor time horizon and risk tolerance.

Market Coverage and Segmentation

In addition to an all-world index, there are indices that cover the broad market in a specific country, or specific sectors. For a specific country index, geopolitical and economic factors are key points to understand. Market valuation is also a critical component of any decision to invest. Sector fund performance is influenced by market cycles within the economy and a thorough analysis is needed.

Investment Horizon

An investor with a shorter time horizon has less tolerance for risk. An investor’s risk profile is of preeminent importance in selecting any investment, but particularly in the case of country specific indices or sector funds.

Conclusion

We encourage potential investors to consider index funds as part of your global equity investment strategy. Through the addition of select index funds as part of a portfolio allocation, an investor can enter markets that otherwise are inaccessible and yet add return and diversification benefits. There are complexities and nuances associated with investing that require expert guidance. Hemispheres Investment Management’s team of seasoned professionals have a 35-year track record of successful investment strategies, including in the Emerging Markets. We can assist you achieve your investment goals.

Please contact Hemispheres Investment Management for a free consultation. We offer individualized guidance and strategies that can help you or your business optimize your investment policy. We can assist you achieve your investment goals.

[1] The Best Value ETFs Of March 2024 – Forbes Advisor Barbara Friedberg,

[2] Falling Mutual Fund and ETF Fees a ‘Big Win for Investors’ | Morningstar Bryan Armour, Ivanna Hampton, October 13, 2023

[3]Mutual Funds: Investing In a Mutual Fund | Vanguard Vanguard website information for VEMRX, VFIAX, VRMGX funds.

[4]Passive Investing vs. Active Investing- Wharton@Work (upenn.edu)