Understanding Sector Rotation

Sector rotation involves dynamic allocation of investments to diverse sectors (or industries) of the economy. The goal of sector rotation is to benefit from market and economic trends. The sectors include Technology, Communication Services, Materials, Consumer Staples, Consumer Discretionary, Industrials, Energy, Utilities, Health Care, Financials, Transportation, Real Estate, etc. Historically certain sectors outperformed the market in specific stages in the economic and market cycles.

As with all forms and strategies of investment, strategies need to be adapted to fit with an investor’s investment horizon and risk tolerance. An important thing to remember is that while investment in specific sectors in a market cycle can lead to outperformance, diversification across many sectors reduces portfolio risk.

Why Implement Sector Rotation

Proper identification of the economic and market cycle enables the investor to adjust portfolio holdings to take advantage of each phase’s performance. Specific sectors outperform in certain phases of the economy and overweighting these sectors can lead to outperformance. Reducing exposure to a fully valued sector is an important form of risk management. Proper identification of economic and market cycles is easier said than done but we will outline the more common strategies below.

The Economic Cycle and Sector Performance

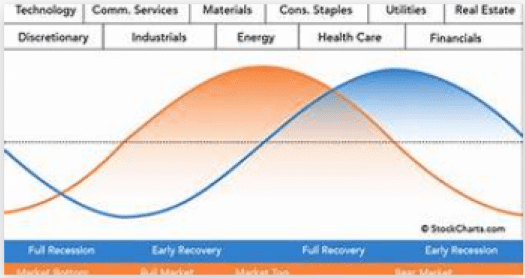

Economies are cyclical and the cycles vary in duration. This makes understanding of the exact position in the cycle difficult to identify in the present moment. The typical economic cycle has periods of expansion, peaks or tops, contractions and troughs or bottoms.

Historically, the consumer discretionary and technology sectors perform well during periods of economic expansion. As the economy peaks, inflation may make energy and materials attractive sectors. During a recession, investors like to increase holdings in defensive sectors like utilities, healthcare, and consumer staples. At a trough, cyclical sectors like industrials and financials have historically done well in anticipation of economic recovery.

To illustrate the difficulty in identifying the current position in the cycle, we will discuss economic recession. An economic recession is also known as a contraction. The National Bureau of Economic Research (NBER) is the authoritative entity that declares and dates the recession in the US. The NBER defines a recession as “a significant decline in economic activity spread across the economy, lasting more than a few months, normally visible in real GDP, real income, employment, industrial production, and wholesale-retail sales”.[1] The Bureau of Economic Analysis stated that “the often-cited identification of a recession with two consecutive quarters of negative GDP growth is not an official designation of a recession in the US.” It is a good rule of thumb used by the market however until NBER issues its report.

Key Indicators for Sector Rotation

Official declarations of recession by the NBER lag market actions. Market participants evaluate and respond to economic indicators upon release by various government agencies. There are three types of indicators viewed by market participants. Leading Economic indicators, those that provide a picture of the outlook ahead. Coincident indicators confirm the current economic condition within a specific area. Lagging indicators provide observable or measurable factors that change after the variable that it is correlated with changes.

Real GDP is the measure of economic growth excluding inflationary factors and therefore inflation is heavily scrutinized. Inflation is also important as a gage to determine whether the Federal Reserve will adjust interest rates. Inflation is a major factor influencing market and sector performance. There are other indicators that market participants evaluate when making decisions regarding market and economic cycle information[2].

Leading Economic Indicators may help forecast future economic activity, although they can be conflicting and lead to market volatility. When multiple leading indicators confirm one another, investor confidence is higher and can be helpful in determining economic cycle position. Examples of leading economic indicators include purchasing manager’s index, durable goods orders, consumer confidence index, jobless claims, the yield curve. While not a leading indicator, company earnings reports can be insightful in determining the health of the economy.

Sector Rotation Strategies

Valuation Metrics

Hemispheres Investment Management (HIM) is an All-Cap Global Value Manager. Our investment process begins with bottom-up analysis to identify undervalued opportunities at the individual company level. Metrics such as price to earnings, price to book value, dividend yield, price to economic value and more to evaluated. Combined with fundamental analysis we determine fair market value.

An undervalued stock could be due to a temporary setback at a company, or it could be sector and market/economic cycle related. As a result, our investment style is “sector aware.” Hemispheres would overweight an undervalued sector if the industry fundamentals supported the allocation. Rotating into these undervalued sectors can result in significant profit potential as industry valuations normalize.

Rotation based on Momentum

In today’s era of technology, there are many tools available to assess sector or company specific momentum. These metrics can help make informed allocation and portfolio rebalancing decisions. One helpful tool is the relative strength index (RSI). The RSI evaluates the speed and change of price movements to determine whether a sector index or individual stock is overbought or oversold. This tool can guide the investor toward sectors gaining or losing strength.

Seasonality

While Hemispheres Investment Management is not a short-term investor, there are investors who trade short term seasonal trends in sectors. An example of this would be the retail sector with expected gains during the holiday season. Historical data can help investors make this assessment, however not all historical patterns are consistent.

Interest Rate and Inflation Outlook

Interest rate and inflation outlook play a significant role in sector rotation. There are sectors that are very interest rate sensitive. High interest rates result in lower profits for companies/sectors that rely heavily on borrowing. Examples include small cap companies, utilities, and REITs.

Periods of high inflation can also heavily influence sector rotation. Commodity related sectors are a favorite allocation during periods of high inflation.

Risks and Challenges of Sector Rotation

Predicting economic cycles is very difficult. Sector rotation through analysis of economic cycle alone is a form of market timing. Historically, it is not a profitable strategy. Utilizing economic and market data in conjunction with fundamental analysis (company fundamentals, sector outlook, regulation, etc.) and valuation data can point you to a sector that can outperform.

Trend Trading

Waiting until a trend is firmly established can result in reduced return potential associated with the investment. Furthermore, the higher the valuation of the security/sector, the closer the investor is to either fair market value or, the cyclical top. In either scenario, the risk/return profile may be less than favorable.

While the above commentary is correct, we will acknowledge that trend trading was a successful strategy, during the long market expansion achieved during the low interest rate environment of the recent past.

Diversification

Investors need to establish sector and security position limits to ensure their portfolio is properly diversified. The MSCI -All Country World Index contains forty-seven individual country stock markets (23 Developed and 24 Emerging Markets). In these markets, there are over 10,000 companies with a market capitalization greater than $1 billion. This compares to slightly over 2,000 in the US. The emerging market companies have an average correlation from 1988 to 2023 of 0.60 compared to the US markets. There are many outstanding investment opportunities globally.

Conclusion

Hemispheres Investment Management’s team of seasoned professionals have a 35-year track-record of successful investment strategies, including deep proficiency investing in US, international developed and emerging markets. HIM utilizes performance metrics and extensive fundamental analysis of companies, sectors, countries, and regions to identify undervalued securities and sectors. Hemispheres is sector, economic cycle, and market cycle aware. Hemispheres can assist you diversify your investments globally. The Global Equities product is Hemispheres flagship product.

Successful sector rotation strategies require an understanding of the economic and market cycle. There are tools and government released data that can assist in making decisions regarding sector allocation. Investor vigilance is required to allocate to appropriate securities and sectors, diversify a portfolio properly and to rebalance frequently as needed. Hemispheres Investment Management can assist you.

Please contact Hemispheres Investment Management for a free consultation. We provide guidance and strategies to assist you optimize your investment policy and help you achieve your investment goals. Book a meeting.

[1] https://www.nber.org/research/business-cycle-dating

[2] Forex Factory | Forex markets for the smart money.