Introduction

Hemispheres Investment Management closely monitors economic and monetary policy adjustments and conditions. We evaluate macroeconomic conditions in the both in the U.S and throughout the world for our flagship product, Global Equities.

Federal Reserve Policy Change and Economic Data

On July 26th, 2023, the Federal Reserve raised interest rates by 25 basis points. The target federal funds rate is now 5-1/4 to 5-1/2 percent.

Today, the release of the second quarter U.S. gross domestic product (GDP) (+2.4%) marks the fourth straight quarter of growth. The strong GDP underlines the resilience of the U.S. economy. Inflation also appears to be declining slowly although it remains above targeted levels. The Federal Reserve has two primary areas of concern at this time. The first is U.S. residential housing, where prices are escalating on a nationwide basis. The fundamentals of the housing market center around historically low interest rates that lock existing homeowners in to existing homes. Therefore constraints exist on the existing housing inventory. For potential home buyers, the low supply of homes is driving prices higher despite higher mortgage rates. The Federal Reserve also follows real estate rental prices, which remain elevated.

The second area of concern for the Federal Reserve is the labor market. Unemployment continues to be very low and wage growth, while slowing, contributes to inflationary pressures. The Federal Reserve carefully examines this data and indicates that additional monetary policy adjustments may be necessary to further drive inflation down.

The Wall Street Journal’s July survey of leading business and academic economists shows a reduction in the probability of a recession in the next 12 months from 61% in prior surveys to 54%. Economists cite the resilience of the economy and dropping inflation as the primary reasons for this reduction. Additionally, there is greater confidence in a soft-landing scenario.

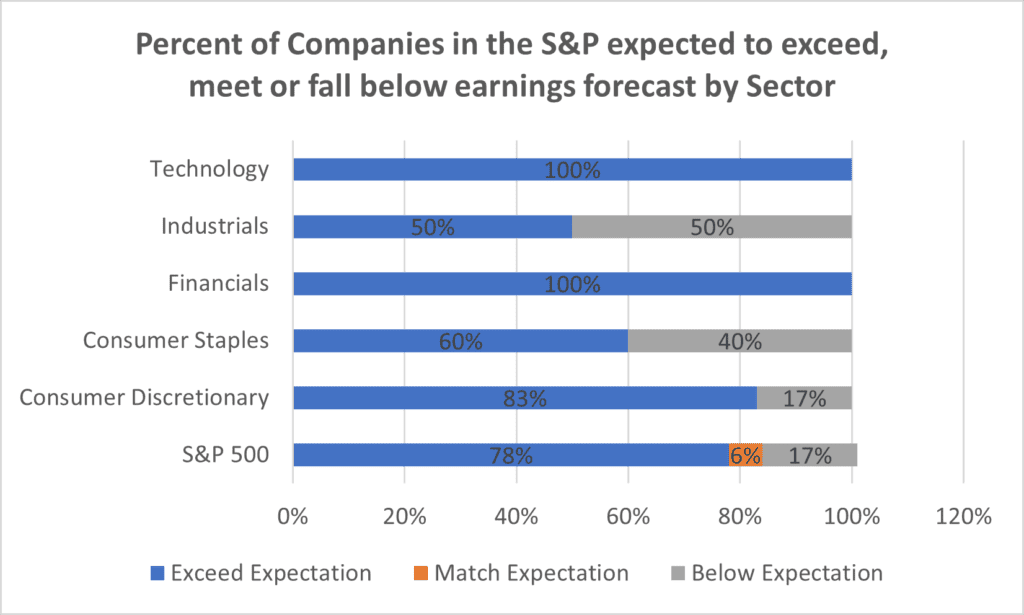

Q2 2023 Corporate Earnings Expectations

Prior consensus predictions among analysts, as reported by Refinitiv, expected aggregate net income for the Standard & Poor’s 500 companies to fall by 6.4% in the second quarter. However, the underlying strength of the economy is prompting a reassessment of these estimates. FactSet reported this week that positive earnings revisions by companies preparing to report actual earnings figures would reach the highest level since the third quarter of 2021.

Source: Refinitiv

Conclusion

This favorable revision in corporate earnings is consistent with Hemispheres’ expectations that the rally will continue to broaden to companies that have not participated in the technology rally year-to-date. We continue to find undervalued stocks and, as always, we invest in industry leading, quality companies on a long-term basis that trade at a discount to their fair market value. We are a global value investment firm with many years investing successfully in this style.

Please feel free to contact us with any questions that you might have. Book a meeting