Introduction

As we head into the May trading period, our thoughts go to the adage “Sell in May, Go Away.” Looking at S&P 500 returns during the month of May since 1994, stocks have gained 73% of the time with an average return of 0.76% for the one-month return. The average annual S&P return over the period is 8.27% and therefore selling at the end of April and re-buying June 1st each year would have reduced the average investment return to 7.51% over the period. Unfortunately, often when investors sell their portfolios, they do not return to the market for many months. If an investor invested in January and exited the markets on the last day of April, the average annual return earned would be 2.83% from 1994 to the present. As demonstrated, long term investment is the most profitable strategy, including in negative return environments.

Factors to consider in 2023:

Corporate Earnings

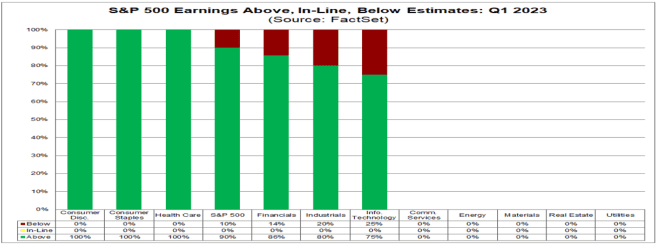

As of April 14, 2023, 90% of those S&P 500 companies who had reported earnings were above expectations while 10% reported earnings that missed expectations. This represented a bullish start to the earnings season. Once again, a long term investment strategy will smooth returns over time.

Source: Factset

Financial Sector

Janet Yellen and various Federal Reserve Governors have given multiple speeches recently indicating that the financial sector is secure. Large financial institutions have reported, and earnings are positive with several cases where deposits rose (JPMorgan Chase for example). Hemispheres remains concerned about First Republic Bank and holds a negative investment outlook for many smaller institutions.

We should point out that large banks continue to have a reasonable margin of safety above minimum reserve levels. Following the Silicon Bank issue in March, the Federal Reserve intervened by opening its borrowing window, providing a reserve backstop. Smaller banks may struggle to maintain profitability and competitive money market returns, leading to continued deposit outflows. Industry consolidation is anticipated as an initial response, with additional government lending needed to ensure reserve adequacy.

Other government measures will include substantial tightening in regulation, particularly for smaller banks. Ultimately, these regulations will strengthen the sector.

Reports suggest that the government will not intervene to rescue First Republic Bank (FRB), despite its significant $100 billion drop in deposits during the first quarter. FRB was provided with intermediation in March when 11 large financial institutions deposited $30 billion with the bank. Recently, FRB’s advisors have requested larger banks to buy bonds from FRB at above-market rates, resulting in a potential total loss of a few billion dollars. Advisors argue that a bank failure at FRB would cost these banks approximately $30 billion in increased FDIC insurance fees. If this effort is successful, other buyers are being lined up to purchase new stock. FRB stock has declined 95% thus far in 2023.

Federal Reserve Interest Rates

Market participants have lowered their probability estimates of another interest rate hike during the Federal Reserve’s next meeting (first week in May) from 89% to 75% due to the difficulties and headline risk associated with FRB. Federal Reserve governors, however, have been hawkish in their speeches, emphasizing the need to raise rates to combat inflation. The FRB crisis may result in a delay a rate increase in May, but it’s likely that rates will be raised in June.

Conclusion

Hemispheres is a value manager investing in industry leading entities with strong fundamentals. Fundamental factors include profitability, positive cash flow, and a well-managed capital structure that provides for a clear ability to service debt and return capital to investors. Portfolios focused on buying solid entities trading at discounted levels reduces risk in portfolios, especially with a long-term investment strategy.

Please feel free to contact us with questions. Book a meeting

Hemispheres Investment Management

Michael Hart, CFA

April 28, 2023