While the U.S. stock market often takes center stage, savvy investors know that opportunity doesn’t stop at the border. International investment, particularly in emerging markets, can be a powerful tool for achieving diversification and often higher returns. Let’s explore why.

The Shifting Landscape of Global Market Capitalization

It’s easy to assume the U.S. dominates the global stock market, and while it’s true that U.S. companies hold a significant share, the landscape is shifting.

- The U.S. Share: As of April 30, 2025, the U.S. stock market accounted for roughly $48.7 trillion, or 63.7% of the global market capitalization, per the MSCI All Country World Index[1]. This is a considerable portion, representing way over half of the total value of all publicly traded companies worldwide. There are reasons for the increase in the U.S. share of the global market capitalization including:

- Strong U.S. vs. International Equity Performance: This increase was driven by the strong performance of the U.S. stock market, particularly in the technology sector, compared to other regions in the past few years.

- Other Factors Contributing to U.S. Outperformance:

- Continued innovation and dominance in technology

- Strong corporate earnings

- Relatively robust economic growth

- Safe-haven appeal of the U.S. dollar

- The Rest of the World’s Share: The remaining 36.3% of global market cap, valued at approximately $27.8 trillion[2], resides in companies outside the U.S. A vast investment opportunity exists outside of the domestic market. Highlighting this opportunity, consider that as of May 20, 2024 there were 1,952 publicly listed companies in the U.S. with a market capitalization greater than $1 billion. Worldwide there were 10,614.[3] Many of these companies are industry leaders with solid financial fundamentals.

The Cyclical Nature of Market Performance

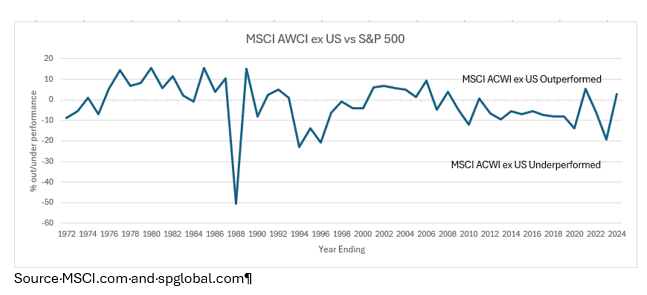

History shows us that market leadership is cyclical. Since year end 1972, the U.S. market has outperformed the MSCI ACWI ex-U.S. (a broad international index) 51% of the time, while the ACWI ex-U.S. has outperformed 49% of the time. This underscores the importance of a long-term perspective and a globally diversified portfolio.

Cyclical Factors in Emerging Markets

Many emerging market economies are highly reliant on specific commodity prices which are cyclical. When commodity prices are high, the economy and corporate profits are robust. Profitability is reflected in stock market performance; the reverse is also true. Another factor impacting all international investment is U.S. dollar strength. The stronger the U.S. dollar relative to a given foreign currency, the greater the negative effect on portfolio performance from that country.

Cyclicality in the U.S. market

Historically, the top 10 stocks in the S&P 500 made up an average of 24% of the index from 1880 to 2010. As of 2024 however, this concentration rose to 38%.[4] Currently market valuations in the U.S. stock market are very high relative to historical averages despite the recent sell-off. Currently, domestic markets are volatile and the high valuations may not be sustainable.

Emerging Markets: Growth and Value

Emerging markets, which are countries experiencing rapid economic growth and industrialization, offer compelling investment potential.

- Higher Growth Rates: Emerging market economies often grow at a faster pace than developed economies, providing opportunities for higher investment returns.

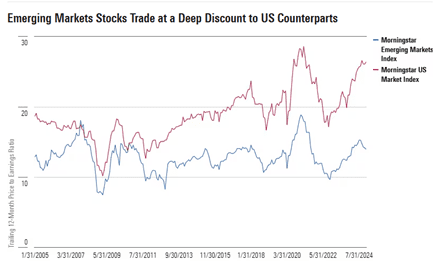

- Current P/E Ratios (as of March 5, 2025)

- S&P 500: The forward P/E ratio for the S&P 500 is 23.76x earnings. This is considered somewhat elevated compared to historical averages.

- Emerging Markets: Emerging markets forward P/E is 14.1x, a significant discount to the domestic market.

What This Means for Investors

- Potential for Higher Returns in International Markets: Lower P/E ratios have been associated with higher future returns. This suggests that international markets, particularly emerging markets, might offer greater return potential compared to the U.S. in the coming years.

- Valuation Gap: The significant valuation gap between the U.S. and other markets is something investors should pay attention to. It could present an opportunity to diversify into markets with potentially more attractive valuations.

- Not a Guarantee: Of course, P/E ratios are just one factor to consider. Other factors like economic growth, political stability, and currency fluctuations can also impact investment returns.

Important Considerations

- Reasons for the Valuation Gap: There are various reasons for the valuation gap, including differences in sector composition, growth prospects, and risk perceptions. It’s important to understand these factors before making investment decisions. This gap increase was driven by the strong performance of the U.S. stock market, particularly in the technology sector, compared to other regions.

- Diversification: Diversifying across different markets and asset classes can help manage risk and potentially enhance returns.

The MSCI ACWI: A Global View

The MSCI ACWI (All Country World Index) is a valuable tool for understanding the global investment landscape. It includes 23 developed markets and 24 emerging markets, providing a comprehensive view of investment opportunities across the globe.

Why Invest Internationally?

- Diversification: International investments can help diversify your portfolio, reducing overall risk by spreading investments across different economies and currencies. Diversification benefits are measured through correlation coefficients. The lower the coefficient, the better the diversification benefit is between asset classes.

- U.S. Markets and International Developed Markets: The correlation coefficient, which was sourced through Bloomberg, between the S&P 500 and the MSCI ACWI for the period 1988 through 2023 was 0.91. This strong positive relationship means the U.S. market and developed international markets (like those in Europe and Japan) tend to move in the same direction in a synchronized way.

- U.S. Markets and Emerging Markets: Utilizing Bloomberg data for the same period, 1988 – 2023, the correlation coefficient between these asset classes is 0.6 suggesting only a moderate positive relationship. Therefore, while the U.S. market and emerging markets often move together, they do so with less synchronicity than the U.S. and developed markets. This provides investors with a significant opportunity to reduce overall portfolio risk.

- Growth Potential: Emerging markets offer the potential for higher growth rates than developed markets. This is largely due to improved demographics with larger growth in employment age populations, improving education and in many cases adoption of technologies.

- Performance opportunity: As mentioned, emerging markets often trade at lower valuations, potentially providing more attractive entry points for investors. The following chart of the Trailing 12-Month Price to Earnings ratio demonstrates the relative P/E differential between Emerging Markets and the U.S. market index. Morningstar was the source.

The GDP gap between the U.S. and the rest of the world argues for higher allocations to international stocks.

The U.S. share of global GDP is estimated by Morningstar to be around 24%. This compares to its share of global market cap of 48.6%. This raises the question of whether the U.S. market cap dominance is sustainable in the long run.

Factors to Consider

- Global Economic Shifts: Emerging markets are growing faster than developed economies. As they mature, their stock markets could become more significant, potentially reducing the U.S. share over time.

- Sector Composition: The U.S. market has a higher concentration of technology companies, which have experienced significant growth in recent years. If other sectors or regions see stronger growth, this could affect the relative market caps.

- Investor Sentiment: Investor preferences and flows can influence market valuations and the relative size of different markets.

Risks of International Investing

While international investing offers compelling advantages, it’s important to be aware of the risks:

- Political and Economic Instability: Particularly in emerging markets can be more susceptible to political and economic volatility.

- Currency Fluctuations: Changes in exchange rates can impact investment returns.

- Liquidity Risk: Some emerging markets may have less liquid markets, making it harder to buy and sell investments although the larger cap stocks enjoy liquidity, especially for those that trade as ADRs on the U.S. exchanges.

Conclusion

We feel that 2025 could be a very good time to invest internationally if such investment meets your individual suitability requirements. The extended valuations of U.S. stocks, the concentration risk associated with such a disproportionate level of market capitalization centered in 10 stocks compared to international countries is compelling. International countries have and continue to lower interest rates which will help economies to grow. Emerging market economic growth rates are higher than the growth rates in developed nations. International and emerging market stocks trade at discounted levels to U.S. stocks and there are many market-leading companies to invest in. By looking beyond the familiar and embracing international and emerging market investment, you can unlock new opportunities for growth and diversification. Partnering with a professional investment manager can help you navigate the complexities and build a portfolio that positions you for long-term success.

Hemispheres Investment Management

Hemispheres Investment Management is a wealth manager with a global (domestic and international investments in the same portfolio) investment management focus. Our team of seasoned professionals each have over 35-years of experience researching, managing or strategizing investments and investment portfolios, including deep proficiency in U.S., international and emerging markets. Hemispheres can assist you in diversifying your portfolio globally. Global Equities is Hemispheres’ flagship investment product.

Please contact Hemispheres Investment Management for free consultation. We provide guidance and strategies to assist you in optimizing your investment policy and helping you achieve your investment goals. Book a meeting.

This article is for informational purposes only. Consult your financial advisor regarding the suitability of any individual security or sector before investing.

[1] MSCI ACWI statistics May 20, 2025

[2] Bloomberg May 20, 2025

[3] MSCI.com and spglobal.com

[4] https://www.visualcapitalist.com/charted-sp-500-market-concentartion-over-145-years