Introduction

The goal of a capital preservation investment strategy is to, at a minimum, maintain the original capital in your investment account without suffering permanent loss. Investors can manage portfolios in many ways to balance factors such as their time horizon (the time until they need cash distributions and risk tolerance. Domestic and Global Equities markets are volatile in the short term and investor psychology can lead to decisions that result in unnecessary capital losses. This article will demonstrate the importance of capital preservation and discuss methods to achieve preservation of capital without the potential drawbacks to an overly conservative investment policy.

Why Capital Preservation Matters

Capital Preservation is critical. Investors need to balance capital preservation with capital growth to achieve their long-term financial goals. To demonstrate the importance of capital preservation: a 50% loss in an investment portfolio would require earning a 100% return to break even. Earning a 100% return could take a significant amount of time.

Investors would structure a portfolio solely to achieve capital preservation by investing in cash or short-term Treasury instruments. While this could be acceptable on a short-term basis, the rate of return earned on these assets would not keep pace with inflation. An investor’s long-term goals would certainly not be met if returns are below inflation. Fortunately, investors can adopt many strategies incorporating capital growth to improve their returns and minimize long-term volatility.

Strategies to Achieve Capital Preservation

Maintain a Long-Term Perspective

On October 31, 2007, the stock market peaked, and markets declined through March of 2009. This decline represented the greatest financial crisis of a generation. The Nasdaq composite declined 55.8% during these months. Many individual investors panicked and sold their stock holdings at or near the cyclical bottom. For patient investors, who held their positions, the Nasdaq composite recovered 100% of losses in a little over 2 years from the market bottom. Worse still, many of those who lost capital were slow to reenter the market thereby suffering an opportunity loss. Between the market bottom on 3/31/2009 and today, the Nasdaq gained 1,195.92%. The patient investor always wins. Capital Preservation strategies perform best when an investor’s focus is not on short-term market fluctuations.

Diversification is Critical to Achievement of Capital Preservation

Portfolio Diversification is a capital preservation strategy that attempts to reduce overall portfolio volatility. Diversification limits exposure to any single asset within a portfolio by allocating capital to a mix of various investments. “Don’t put all of your eggs in one basket” is an age-old idea that continues to be true today. Individuals can diversify their portfolios by investing in various asset classes like US stocks, global equities, bonds, real estate, or other alternative investment vehicles. Alternate investments include items such as exchange traded funds, cryptocurrency, commodities, cash, and cash equivalents, etc.

You can achieve portfolio diversification by adding multiple asset classes or by evaluating ‘correlation coefficients’ within a single asset class. Correlation coefficients highlight the relative movements of various investment opportunities, whether they move in the same direction or not, and the degree to which they move. Through the addition of securities with low, or even negative correlation coefficients, positive performance of some investments offsets the negative performance of others. By doing so, you smooth investment returns, providing a more consistent level of portfolio performance for investors and proving it as a risk management method. For more information on strategic diversification and risk management, please refer to our article dated, March 18, 2024.[1] We will further demonstrate this principle by highlighting fixed income investing.

[1] Strategic Diversification in Global Equities Investing (hemispheresim.com)

The Fixed Income Asset Class – Excellent Diversification Potential

Fixed Income securities primarily include bonds where investors receive a “fixed” interest payment on a predetermined periodic basis, usually quarterly or semi-annually. The correlation coefficient between investment grade bonds and the S&P 500 between 1988 and 2023, as reported by Bloomberg is only 0.05. Statistically, a correlation factor of 0.7 or less means that adding a different asset class or an individual security to a portfolio offers diversification benefit, lowering overall portfolio volatility. Bonds therefore are an excellent way to achieve capital preservation by stabilizing returns.

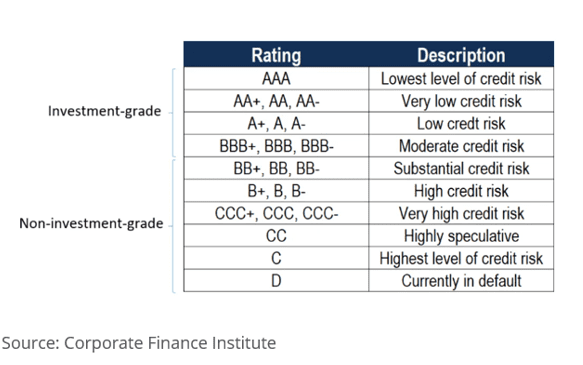

Three major rating agencies (Standard & Poor’s, Moody’s, and Fitch) rate bonds. The ratings assist investors determine the risk of a specific security. Investors can then construct a portfolio consistent with their risk tolerance. A primary form of risk assessed is the determination of creditworthiness, or the probability of credit default. It is important to note that yields for the higher quality bonds are lower than for lower quality bonds. This is the main reason that US corporate bonds generally trade at higher interest rates than a US government bond.

Historically default rates on investment-grade corporate bonds have been very low and solid fundamental analysis can assist in avoiding vulnerable securities. The following chart describes and defines the various ratings for investment-grade and non-investment grade bonds. S&P and Fitch rate bonds using this method.

Default Rates for Global Corporate Bonds – Lowering Risk

The Corporate Finance Institute published an interesting article, citing S&P Global Rating’s 2018 Annual Global Corporate Default and Rating Transition Study reflecting maximum default rates for the various credit ratings of Global Bonds.

“Historically, investment-grade bonds witness a low default rate compared to non-investment grade bonds. For example, S&P Global reported that the highest (historical) one-year default rate for AAA, AA, A, and BBB-rated bonds (investment-grade bonds) were 0%, 0.38%, 0.39%, and 1.02%, respectively. It can be contrasted with the maximum one-year default rate for BB, B, and CCC/C-rated bonds (non-investment-grade bonds) of 4.22%, 13.84%, and 49.28%, respectively. Therefore, institutional investors generally adhere to a policy of limiting bond investments to only investment-grade bonds due to their historically low default rates.”[1]

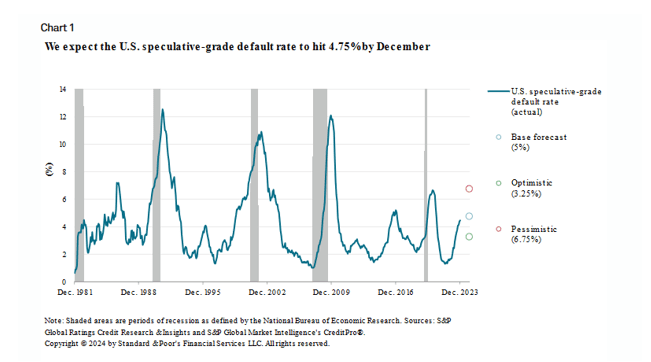

S&P Global published a February 15, 2024 article in which the rating projection for non-investment grade corporate defaults is expected to decline in the 4th quarter of 2024. due to “favorable GDP growth, improving inflation trends and anticipated interest rate reductions”. The overall U.S. trailing 12-month default rate is expected to be higher than in 2023 with an optimistic case of 3.25%, a base case (the most likely case) of 4.75% and a pessimistic scenario of 6.75% for speculative (non-investment grade) bonds. The pessimistic case represents a 4th quarter recession, which at this point is deemed unlikely.[2] Please note in the chart below that most non-investment grade bond defaults occur in, or immediately after a recession.

[1] Investment-Grade Bonds – Overview, Default Rates, Example (corporatefinanceinstitute.com)

[2] Default, Transition, and Recovery: U.S. Speculative-Grade Corporate Default Rate To Hit 4.75% By December 2024 After Third-Quarter Peak | S&P Global Ratings (spglobal.com)

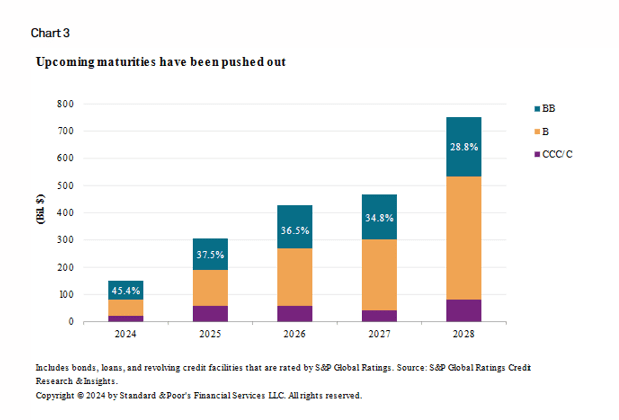

Low Current Maturities of Debt Can Reduce Default Risk

Another factor leading to a reduced default risk forecast currently is corporate management of existing debt. Management teams refinanced and extended debt maturities when interest rates were lower. By pushing out the debt maturities into the future, companies have more time to improve credit ratings, secure alternate financing and reduce cash requirements in the immediate future. As shown in the chart below, this trend is particularly pronounced in the single B rated credits. In recessionary periods, lower rated companies have a more difficult time accessing bank or investor capital and because these precautions have been taken, risk of default is reduced.

Hemispheres fixed income portfolio primarily utilizes high quality bonds with very low default rates. When we do choose to invest in a non-investment grade bond we perform extensive analysis. When combined with maximum position sizing we reduce risk substantially while earning enhanced returns for investors. In the past few quarters, the Fixed Income asset class was attractive from a risk and return perspective.

Investing in Defensive Sectors of the Stock Market

Investors can adopt a defensive strategy through investment into traditional defensive sectors. Many sectors outperform during specific business cycle environments. Examples of defensive sectors historically included Utilities, Consumer Staples, and large health care concerns such as pharmaceuticals. As investors collectively get concerned about stock market fundamentals, we tend to see rotation into defensive sectors. This is a market timing method. The success of such strategies may be more related to momentum investing than accurate timing of a market.

Choosing Quality

Hemispheres Investment Management is a multi-cap, value investor. Through diligent analysis, Hemispheres Investment Management selects the most attractive valued stocks from the over 45+ investible global stock markets. Hemispheres is a bottom-up manager, meaning that its process for security selection begins at the individual company level; utilizing a disciplined approach that includes investing in companies that are fundamentally attractive. Hemispheres looks to invest in higher quality companies that offer stable earnings, healthy balance sheets and cash flow.

We assess competitive advantages based on superior products, management teams and cost efficiencies, etc. Industry leaders generally outperform weaker stocks in both favorable and weak market conditions. Hemispheres looks for leading companies in each sector, country, and region of the world. Global Equities has a universe of over 10,000 companies with a market capitalization more than $1 billion to invest in compared to 2,000 + in the United States. Buying undervalued stocks from the standpoint that fully valued or overvalued stocks are riskier considering that their return is vulnerable to stock market decline or a decline in fair market value. We would refer you to our March 12, 2024, article on Market Capitalization to gain our insights on that topic.[1]

[1] Market Capitalization Explained: What You Need to Understand (hemispheresim.com)

Dividend Stocks

Companies that have a history of consistent dividend payments and steady increases in the payout are indicative of a financially healthy entity, although thorough evaluation of financial fundamentals is necessary. Dividend-paying stocks can mitigate portfolio volatility and enhance overall returns. In low inflation environments before 2022, dividend stocks often lagged growth stocks, particularly in the technology sector. However, many large capitalization growth stocks, including tech companies, now also pay dividends. During periods of declining stock prices, dividends can counterbalance share price declines.

In inflationary environments, stocks with increasing dividend payouts, aiming to offset inflationary pressures, typically outperform those retaining earnings. According to an April 11, 2024, article by Fidelity, dividends have contributed to 40% of stock market returns since 1930 and 54% during high inflation decades.[1] Given the current inflationary environment, dividend-paying stocks are increasingly attractive. Global equities often pay dividends and, when combined with their low correlation to U.S. markets, offer substantial diversification benefits to investors.

In our May 10, 2024, article entitled, “Dividends: Their Value in a Stock Portfolio” we give further insights into utilizing dividend strategies in an investment portfolio.[2] Investing in dividend paying stocks is another way to preserve capital.

[1] https://www.fidelity.com/learning-center/trading-investing/inflation-and-dividend-stocks

[2] Dividends: Their Value in a Stock Portfolio (hemispheresim.com)

Other Defensive Investment Strategies

Hemispheres utilizes a series of risk reduction methodologies to preserve investor capital. The article found in footnote 1 details these methods. The methods, in brief, include limiting holding size. As an example, should a company in the portfolio experience a catastrophic loss and the stock price declines 50% in one year, the effect on the overall portfolio is minimal if the holding is only 1% of the portfolio. Investing in industry leaders and entities with a competitive advantage as discussed above. A temporarily undervalued company can provide both downside protection and long-term profit potential.

Lastly, prudent investing always includes stop-loss limits when a stock does not perform as expected. Regular portfolio rebalancing is critical to maintain the intended asset allocation and protection in economic uncertainty and volatile markets.

Conclusion

The goal of defensive investment strategies is preserving capital. The importance of balancing capital preservation with capital growth cannot be understated. Hemispheres has a consistent, repeatable approach to investing that has proven successful over many years. Market timing strategies are unsuccessful. Hemispheres Investment Management utilizes these risk mitigation strategies on an ongoing basis. A market sell-off becomes an opportunity to add to positions and sectors.

We recognize that individual and institutional investors alike may be new to investing in Global Equities. There are complexities and nuances associated with investing in various markets that require expert guidance. Investing in Global Markets can provide both returns and diversification benefits to our clients. Hemispheres Investment Management’s team of seasoned professionals have a 35-year track record of successful investment strategies. The Global Equities product is Hemispheres flagship product.

Please contact Hemispheres Investment Management for a free consultation. We provide guidance and strategies to assist you optimize your investment policy and help you achieve your investment goals. Book a meeting