Introduction

The primary thesis behind active investment management is that the manager can identify market divergence and opportunistically allocate capital between asset classes to earn higher returns and mitigate risk. For a manager of both Global Equities and Global Fixed Income products, market divergence among countries, sectors and asset classes provides compelling opportunities for investors.

Understanding Market Divergence

Economies and stock/bond markets are cyclical. There are many factors that influence the length and scale of cyclical highs and lows. Economic and market cycles vary significantly between countries and sectors. These variations arise from differences in fiscal policies, monetary policies, consumer behavior, technological advancements, and geopolitical factors. While some economies may experience growth, others may face recessions. Similarly, certain sectors may thrive while others decline. This lack of perfect correlation creates opportunities for diversification, allowing investors to spread risk across various regions and industries. By analyzing these divergent macroeconomic and market trends an investment manager can identify opportunities maximize returns.

Divergence in the Global Macroeconomic Environment

United States

The US Federal Reserve started raising interest rates in March of 2022 in response to inflation. In December 2023, the Federal Reserve signaled potential interest rate cuts contingent on favorable inflation data. This pivot triggered easing financial conditions characterized by increased bond issuance, bond spread tightening, and a rebound in merger and acquisition activity as well as leveraged buy out transactions. Stock market optimism (and liquidity) resulted in favorable first half stock market returns and a re-acceleration in both economic growth and inflation. While the Federal Reserve governors’ statements lead to anticipation of at least one rate cut later this year, they continue to mute expectations through “higher for longer” interest rate commentary.

The US economy’s resilience continues to impress economists. The consensus view of the likelihood of a US recession over the next 12 months dropped to 30%, down from 60% in January 2024. Systemic liquidity fueled the late cycle stock market in the 1H2024. Despite higher interest rates, investment in stocks such as the Magnificent 7 resulted in an increase in market value of $12.5 trillion since November of 2023. The S&P 500 earnings estimate for the next 12 months is solid and we continue to anticipate increased market breadth to provide investment opportunities in domestic equities.

International Monetary Fund Assessment

In its April 2024 World Economic Outlook, the International Monetary Fund (IMF) estimated global GDP growth rate of 3.2% for FYE 2023, which was an upward revision from its previous projection of 2.9%. The 2024 IMF forecast is for stable growth in the US, at current levels before slowing to 3.1% in 2025. In respect to developed markets, the US economy is the primary driver of growth. The IMF further reported that “Many emerging market and developing economies have fared better than expected thanks in part to improved terms of trade for some, proactive monetary policy, and a healthy build-up of external buffers.”[1]

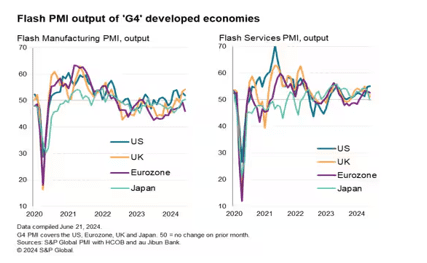

Purchasing Manager Index

Based upon the June flash Purchasing Manager Index, S&P Global reported on June 21, 2024, the G4 economies (US, UK, Eurozone and Japan) continued to expand although the rate of expansion in June was weaker than seen in May. There were also divergences between the US markets, characterized by robust growth of business activity with slowdowns in business activity growth in Europe and Japan. European PPI survey data softened due to political uncertainty ahead of elections in the UK and France. Following the election, this weaker data may prove temporary depending upon election outcomes.

Japan’s outlook is concerning. S&P Global could not trace economic slowdown to any specific factor and the services activity slipped into contraction for the first time in 22 months.

Inflation

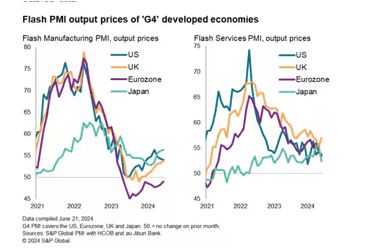

The IMF continues to warn of “sticky” inflation figures. For most of the G4, prices continue to be slightly above their pre-pandemic ten-year average. Japan’s remains elevated due to a weaker yen and increase costs of importing goods and services.

The UK appears to have the most worrisome inflation picture, where June prices rose at the steepest rate in four months. These price increases appeared in both the service sector and in elevated core prices. The UK also continues to have supply chain delays that are driving up prices. “Thus, despite the UK being the only economy in which headline inflation has already fallen to the central bank’s target, the PMI data suggest that the UK’s underlying price pressures remain the most worryingly elevated of the G4.”[2]

Corporate Earnings Divergence

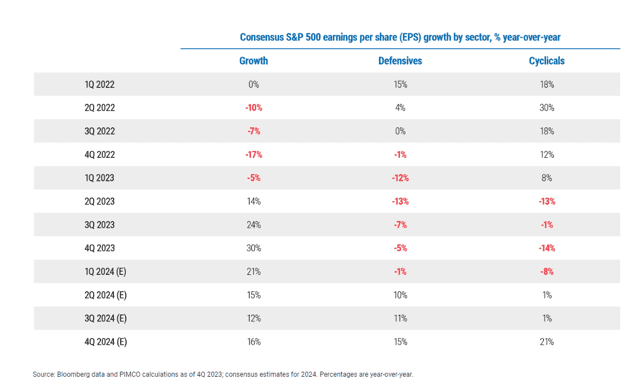

Following the onset of rising interest rates in the US, earnings within market sectors were varied, resulting in sector divergence. The term rolling-recession described the economic situation in 2022 and 2023. The overall economy remained strong, but some sectors contracted while others expanded. A standard recession sees all market sectors affected simultaneously. The chart below demonstrates the consensus S&P earnings per share percentage growth by sector year over year broken down by Growth, Defensive and Cyclicals.

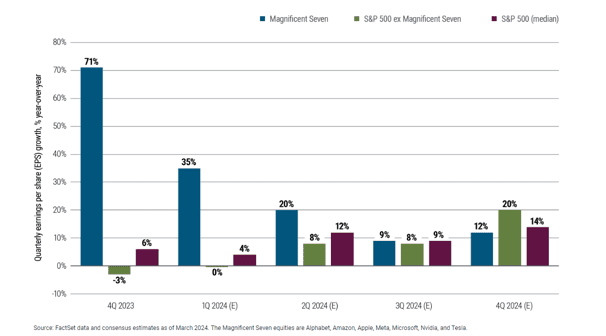

“The timing of these rolling recessions and recoveries could lead to a convergence in EPS growth rates between leaders and laggards in the S&P 500. While the “Magnificent Seven” tech stocks saw 71% year-over-year EPS growth in 4Q 2023, this is expected to moderate to 12% by 4Q 2024 (See chart below). In contrast, for the remaining 493 stocks, earnings are projected to improve from a 3% contraction to 20% growth over the same period.”[3]

Magnificent Seven Dominance in the S&P may diminish in 2024 as other sectors improve

Domestic Equities Asset Class

The clear implication is that there remains value in domestic equities outside the Magnificent Seven. We anticipate market breadth and stock market returns to improve. Hemispheres, as a bottom-up investment manager, analyzes financial fundamentals and constructs portfolios comprising high-quality entities with compelling valuations. Hemispheres portfolios continue to overweight equities relative to fixed income.

Emerging Market Equities Asset Class

Emerging market equities demonstrate both favorable demographic trends, monetary and economic trends. Kent Smetters, professor of business economics at the Wharton School of the University of Pennsylvania and a proponent of passive index investing, observes that value exists in emerging markets. He wrote: “But in certain niche markets, like emerging markets …where assets are less liquid and fewer people are watching, it is possible for an active manager to spot diamonds in the rough.”[4]

Further advantages in respect to Emerging Market Investment include low correlations to domestic markets. Low correlation means that there are significant risk reduction opportunities through diversification.

International Equity Markets – Developed Markets

Hemispheres remains cautious regarding investment in the G4 (ex-US). We monitor economic, political and monetary factors. When sufficiently compensated for risk through compelling valuations and strong company fundamentals, we allocate.

Fixed Income Asset Class

Government stimulus during the COVID 19 pandemic resulted in inflation in most developed markets. Governments raised interest rates to combat inflation. Countries that moderated inflation through early monetary policy decisions are now initiating rate easing. Fixed Income Investments in such an environment would result in capital appreciation.

Risk Management

Risk management practices are as important as the expected return garnered through specific assets. Hemispheres Investment Management manages risk in multiple ways, all of which include weighting limits.

- By Asset Class. the asset classes into which Hemispheres allocates capital correlation coefficients that provide portfolio risk reduction. This is particularly true in allocations to fixed income and emerging markets relative to US Domestic markets.[5]

- By Country. Hemispheres Investment Management invests in countries with favorable economic, political, monetary and regulatory trends and practices.

- By Sector.Hemispheres assesses sector fundamentals and outlook.

- By Company. Sound financial fundamentals, demonstrated quality and compelling valuation determine position size.

- By Valuation. Hemispheres assesses intrinsic value utilizing quantitative metrics such as price/book value ratios, dividend yield and enterprise value to sales. Qualitative factors include asset quality, operating cost structure, cash flow generation, debt positions, outstanding products, competitive position and management quality. We believe that the higher the stock price is relative to its intrinsic value, the higher the risk. When we feel that valuations are nearing full value, we begin to trim positions.

Conclusion

While market divergence occurs frequently and is the underlying thesis behind active portfolio management, the current level of divergence is unusual. This is particularly true between the US and other developed countries. Market divergence provides outstanding investment opportunities.

We recognize that individual and institutional investors alike may be new to investing in Global Equities. There are complexities and nuances associated with investing in various markets that require expert guidance. Investing in Global Markets can provide both returns and diversification benefits to our clients. Hemispheres Investment Management’s team of seasoned professionals have a 35-year track record of successful investment strategies, including deep proficiency in emerging market investing. The Global Equities product is Hemispheres flagship product.

Please contact Hemispheres Investment Management for a free consultation. We provide guidance and strategies to assist you optimize your investment policy and help you achieve your investment goals. Book a meeting.

[1] https://home.treasury.gov/system/files/136/June-2024-FX-Report.pdf

[2] https://www.spglobal.com/marketintelligence/en/mi/research-analysis/g4-flash-pmis-show-us-bucking-a-developed-world-Jun24.html

[3] https://www.pimco.com/us/en/insights/when-markets-diverge-opportunities-emerge

[4] https://executiveeducation.wharton.upenn.edu/thought-leadership/wharton-wealth-management-initiative/wmi-thought-leadership/active-vs-passive-investing-which-approach-offers-better-returns

[5] https://hemispheresim.com/global-equities/