Understanding Fixed Income Investments

Fixed Income securities are debt instruments that pay a fixed amount of interest, called a coupon payment, to investors. The investor is the lender in the transaction, and the borrower is the issuer of the security. The coupon rate, also known as coupon yield, is the interest rate that the issuer will pay the investor. Bond issuers set a fixed rate coupon at issuance, and it remains unchanged over the bond’s life. Issuers pay most coupon payments semiannually, though some securities have monthly, quarterly, or annual interest payment provisions. At maturity, issuers repay the full principal amount (the par or face value), along with the final interest payment. Investors primarily trade bonds over the counter as opposed to on an exchange.

There are many forms of debt securities, including both floating rate and fixed rate debt, each with its own characteristics. This article will focus on recognizable fixed rate debt products and the prevalent risks. The most common form of fixed income securities are bonds. The US Treasury, government agencies, municipal governments, corporations and sovereign nations issue bonds.

Why Choose Fixed Income Investments

- Bonds provide an investor with stable and predictable cash flow. As an example, assume an investor buys a high-quality bond with a $1,000 face or par value with a 6% coupon. In this example, the issuer pays the investor an annual interest payment of $60, usually paid semiannually as $30 every six months. If the investor holds the bond until maturity, he will receive his full principal amount, which is the par value of $1,000.

- Pricing volatility in bonds, especially a higher quality bond, is generally less than equity securities, meaning that they are typically less risky.

- Bond correlation to stocks is very low, thereby adding diversification benefits to a portfolio reducing

- aggregate risk.

- Investment in high quality bonds preserves capital in adverse equity market conditions.

Types of Fixed Income Securities

US Treasury Bills

The US Government issues T-Bills, which are debt instruments that mature in one year or less. Investors buy T-Bills at a discount to their face value and receive the full face value at maturity. The interest earned is the difference between the purchase price and the maturity par value. T-Bills are one of the most liquid securities in the world, and the safest historically. We will mention the risk that we are monitoring that is associated with rapid growth in T-bill supply. Over the past 12 months has increased $2 Trillion and makes up a significantly higher proportion of the US government’s debt outstanding currently. If the Federal Reserve starts cutting rates, banks and other large purchasers of T-bills may result in lower demand, which would pressure short term rates.

US Treasury Notes

The US Government issues US Treasury Notes at auction in maturities of two, three, five, seven, and ten years in increments of $100. The fixed interest rate is set at auction. Interest payments on the notes are not taxable on a municipal or state level. The interest is subject to Federal Tax.

Treasury Bonds

The US Government issues Treasury Bonds with a fixed interest rate, paid semiannually. The interest rate on Treasury Bonds is also determined at auction. The only difference between Treasury notes and Treasury bonds is the maturity. Bonds have maturities of 20 or 30 years. Investors can purchase them in minimum increments of $100, with a maximum purchase size of $10 million. The taxes on US Treasury bonds is the same as US Treasury notes.

Government Agency Bonds

Government Sponsored Entities (GSEs), or Agency Bonds, are low risk, however they are not as safe as US Treasury securities. GSE debt is issued by private corporations, however the US Government backs it with its full faith and credit.

GSEs issue bonds secured by home mortgages, farm, student loans and loans that finance international trade. An example of a GSE would be Freddie Mac.

Municipal Bonds

States, cities, counties, and other government entities throughout the US issue Municipal Bonds to finance capital projects such as building freeways or schools. Interest on municipal bonds is typically exempt from federal income tax. Many municipalities grant state and local tax exemptions to investors residing in the locality where the bond is issued. Due to these tax advantages, municipal bonds usually offer lower interest rates to investors. Investors must consider the issuer’s financial health before investing, as not all municipalities have the same credit quality. Two common types of municipal bonds are:

- The issuer backs General Obligation bonds with its full faith and credit. The bondholder is paid principal and interest through the municipal’s tax revenues.

- A municipality funds a specific project using Revenue Bonds, and repays bondholders with the cash flow generated from that project. Toll road fees are a common example. The municipal government does not back the bonds with its full faith and credit or its taxing power. Some municipalities opt to improve the quality of the revenue bond with bond insurance.

Sovereign Bonds

National governments around the globe issue Sovereign Bonds to fund various spending needs, such as infrastructure development, social programs, and current portion of debt and interest on outstanding debt. Sovereign bonds often denominate in local currency or in a global currencies like US dollars or Euros.

Sovereign Bonds pay coupon payments at regular intervals. Many investors who allocate to sovereign debt do so through a combination of individual security selection combined with ETFs.

Corporate Bonds

Corporations issue bonds to fund operations and growth. Funds can pay for items such as inventories, capital expenditures, acquisitions, etc. Corporate bonds can differ widely in structure, coupon, maturity, collateral and credit quality to name a few features. These corporations can be US, developed country or emerging market domiciled companies. Because corporate bonds are riskier than US government bonds, interest rates are higher.

Common Risks

Interest Rate Risk (or Market Risk)

This is the risk that changes in interest rates—in the U.S. or other world markets—may reduce the market value of a bond you hold. Bond prices move inversely with interest rates. If interest rates go up, the market value of the bond would drop. If an investor chose to sell the bond prior to maturity after market wide interest rates increase, the bond would sell at a capital loss. Bond pricing is based on the present value of the expected cash flow. The higher interest rate reduces the discounted value of the cash flow.

A simpler way to view the price/interest rate relationship would be based on supply and demand. When interest rates rise, investors are more likely to sell their lower yielding bond and purchase a higher yield alternative. Selling pressure associated with many investors selling the lower interest rate bond would result in a lower bond price. The opposite is true as well, if interest rates drop, the market value of the bond rises if it is not nearing maturity. At maturity, the investor receives the par value of the bond.

Credit Risk (Default Risk)

This is the risk that the borrower fails to meet the terms and conditions stipulated in the lending agreement. This would include failure to pay interest and principal payments when due.

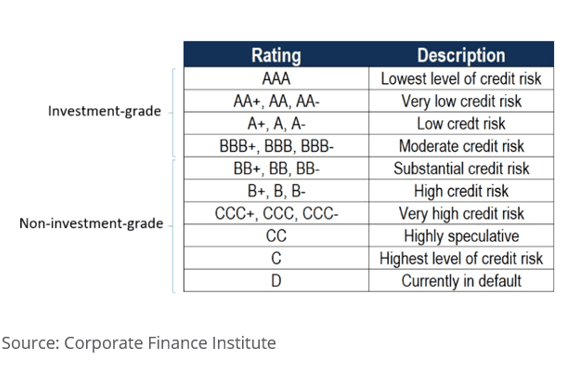

Credit Rating Downgrade Risk

The three major bond rating agencies are: Standard & Poor’s, Moody’s and Fitch. These three ratings agencies grade all categories of bonds in the United States and Internationally. A bond rating is a method of evaluating the quality and safety of a bond. This rating is based on an examination of the issuer’s financial strength and the likelihood that it will be able to meet scheduled repayments. The chart below defines the bond rating categories based on Standard & Poor’s rating system, which Fitch also uses. Moody’s nomenclature differs slightly but the categories and definitions are the same.

The lower the bond rating, the more interest investors demand for assuming heightened risk, including default risk. A default could result in total loss of principal as well as future interest payments. In recessionary environments, default rates, especially among the lower rated credits increases.

Rating agencies rate sovereign issuances, including the US, US Agency debt, US Corporates as well as foreign developed and emerging market corporate debt.

Inflation Risk (or Purchasing Power Risk)

This is the risk that the yield on a bond will not keep pace with purchasing power. For instance, if you buy a five-year bond in which you can realize a coupon rate of 5 percent, but the rate of inflation is 8 percent, the purchasing power of your bond interest has declined. All bonds but those that adjust for inflation, such as Treasury Inflation-Protected Securities (TIPS), expose investors to some degree of inflation risk.

Liquidity Risk

This is the risk that the investor won’t easily find a buyer for a bond that no longer meets the desired portfolio configuration. Bonds are generally less liquid than stocks that trade on exchanges.

Event Risk

For a corporation, this is the risk that an event, such as a merger, acquisition, corporate restructuring or other event might change a corporation’s financial fundamentals. The event could trigger a change in a bond’s rating. Event risk is extremely hard to anticipate and might have a dramatic and negative impact on bonds.

Sovereign Risk

A nation’s unique political, monetary, and economic policies and health are all facets of sovereign risk. Sovereign risks are susceptible to event and liquidity risk. Sovereign risk is the risk that the country could default on its debt. The rating agencies evaluate these features.

Conclusion

Fixed Income investment, with its low correlation to equities, is an excellent way to diversify a portfolio. Diversification lowers portfolio risk. Bonds provide an investor with stable and predictable cash flow and volatility is generally lower than stocks. Capital preservation strategies include bonds as safe haven investments. Through careful and detailed fundamental analysis, much of the credit rating and default risk can be avoided in a portfolio.

Many governments of the world are nearing the end of the interest tightening cycle. Several countries are now indicating rate reductions are on the horizon. Fixed Income investors currently benefit from bonds with higher coupon rates while looking forward to capital appreciation garnered as interest rates fall.

We recognize that individual and institutional investors alike may be new to investing in debt securities, particularly those domiciled globally. There are complexities and nuances associated with investing in various markets that require expert guidance. Investing in Global Markets can provide both return and diversification benefits to our clients. Hemispheres Investment Management’s team of seasoned professionals have a 35-year track record of successful investment strategies, including deep proficiency in emerging market investing. These investment strategies include the Hemispheres Core-Plus Bond portfolio as well as Hemispheres’ flagship product, Global Equities.

Please contact Hemispheres Investment Management for a free consultation. We provide guidance and strategies to assist you optimize your investment policy and help you achieve your investment goals. Book a meeting.