Introduction

The world’s major economies are currently experiencing the most rapid demographic shift since World War II. This demographic shift has the potential to reshape the macro and investment landscape for decades to come. Since the nineteenth century, the demographic trends in major economies have witnessed lower mortality and fertility rates. These trends pose challenges in respect to future economic growth and other structural elements of the economy. Government policies will, and are in the process of adapting to manage these changes. The specific policy changes that are adopted will influence future economic stability and prosperity, especially for countries with the greatest challenging demographic trends. Hemispheres Global Equities product captures the benefits associated with these demographic shifts. It invests in developed and emerging markets that enjoy more favorable demographic trends.

Effect of Aging Population on Economic Growth in Developed Countries

Economies with younger, working-age populations (ages 25-54) generally experience improving gross domestic product (GDP) trends. Economies with aging populations must allocate a significantly higher share of national income to social and health care costs. Governments must alter policies to mitigate these costs or devise productivity gains to offset the decline. Countries such as China, Germany, Italy, and many of the Eastern European Countries have the most challenging demographics currently.

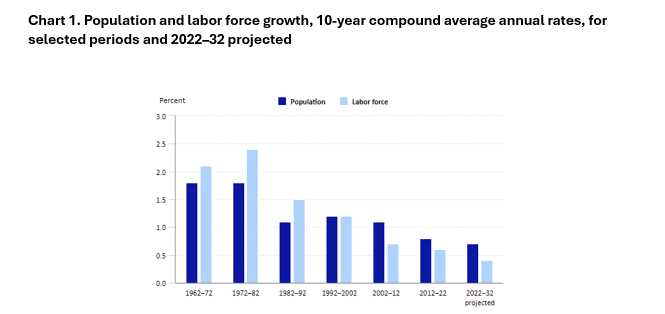

According to the US Bureau of Labor Statistics (BLS), “changes in the labor force have an outsized effect on economic growth. Slower labor force growth over the last few decades has contributed to slower gross domestic product (GDP) growth. The slowdown in labor force growth has been driven by two demographic trends: lower population growth and an aging of the U.S. population. The labor force grew 0.6 percent annually from 2012 to 2022, much slower than in the 1980s and 1990s, when growth exceeded 1 percent, and in the 1960s and 1970s, when growth exceeded 2 percent. (See chart 1 below) Through 2032, BLS projects the labor force to grow 0.4 percent annually as the aging of the population accelerates”.[1]

Work Force Participation Rates

Several underlying trends are occurring in the labor force. In addition to an aging population, the overall work force participation rates are declining. In November 2023, The BLS projected the US labor force participation rate to decelerate, declining to 60.1% in 2031 from 61.7% in 2021 and that the slow rate of labor force growth would restrict overall economic growth and potentially lower economic output.

“The gap between men’s and women’s participation rates is expected to continue to narrow. This is especially true for prime-working-age people (those ages 25 to 54), among whom the women’s participation rate has been increasing while that for men has been decreasing. The recent increase in labor force participation for women ages 25 to 34 coincides with a decreasing fertility rate, which is holding down population growth. The participation rate of young people (those ages 16 to 24) is projected to continue its downward trend”.[1]

Wage Growth

Due to a shrinking number of qualified candidates, corporations very likely will need to offer attractive compensation packages. Higher wages generally contribute to inflation. Government policy in respect to enhanced immigration and education policies could alter this demographic trend.

Inflation

In addition to demographic shifts, the world is facing several other important macroeconomic shifts which contribute to inflation. To combat global warming, developed countries are attempting to transition from fossil fuels to cleaner energy sources. Governments are investing vast sums to implement the transition. This policy, while promising long-term benefits, currently is both a drag on GDP growth and inflationary. Furthermore, adoption of these clean energy sources is, in many cases, taking longer than anticipated. Therefore, the economies of the world continue to be highly reliant on oil as an energy source. Because of diminishing drilling rates and inventories, rising oil prices would further add to inflationary pressure.

While risks exist as technology evolves, we foresee investment opportunities in this sector.

De-globalization

The world is becoming less interconnected through trade. This trend is potentially negative in terms of economic growth and corporate profits. This in turn will change the dynamic of investment opportunity in an as yet unknown way. Causal factors included supply chain disruptions associated with COVID and geopolitical tensions such as the Russian-Ukrainian war. More recently, differences in green power transition policies are leading to threats/realization of tariffs that reduce trade.

While trusted trade partnerships continue to function well, there is increased reliance on domestically produced supply chains. For the near future, at a minimum, the build-out of domestic supply chain contributes to inflationary pressure.

An exception to the de-globalization trend is the developed nations’ reliance on green energy minerals and metals. These metals are sourced from specific countries, for example the Democratic Republic of Congo. Global cooperation will be required to transition to green energy.

As always, analysis of company fundamentals as well as careful attention to trade partnerships will provide investment opportunities in the future in this environment.

Artificial Intelligence

Firms and the government are investing heavily on AI to improve employee productivity and lower future corporate operating costs. AI capability can offset shrinking work forces. The huge expenditures currently contribute to inflation but provide the promise of life altering technologies, medical treatments and pharmaceutical advances. All this potential is great cause for optimism in the future of our society, and for investment opportunities.

Interest Rates

The Federal Reserve started raising interest rates in March of 2022 in response to inflation. In December 2023, the Federal Reserve indicated that interest rate cuts could be implemented when supported by favorable inflation data . This pivot triggered easing financial conditions characterized by increased bond issuance, bond spread tightening, and a rebound in merger and acquisition activity as well as Leveraged Buy Out transactions. Stock market optimism (and liquidity) resulted in favorable first half stock market returns and a re-acceleration in both economic growth and inflation. While the Federal Reserve governors’ statements lead to anticipation of at least one rate cut later this year, they continue to mute expectations through “higher for longer” interest rate commentary. The other macroeconomic trends discussed in this article further support this thesis.

As a result of higher rates, the fixed income asset class is an attractive alternative to equities.

Demographic Trends and Macroeconomic Impact on Equity Prices

Without policy change, a declining workforce would weigh on equity valuations in developed markets. Equity prices historically are inversely correlated with interest rates. Higher interest rates reduce profitability, particularly for companies with higher debt levels. The opposite is also true, companies with low debt are less sensitive to interest rates.

All of this being said, the US economy’s resilience continues to impress economists. The consensus view of the likelihood of a US recession over the next 12 months dropped to 30%, down from 60% in January 2024. The late cycle stock market rally continues to be fueled by significant systemic liquidity and investment in stocks such as the Magnificent 7, resulted in an increase in market value of $12.5 trillion since November of 2023. S&P 500 earnings estimates for the next 12 months are solid and we continue to anticipate increased market breadth to provide investment opportunities.

As the demographics shift, we expect to see change in consumer buying patterns. There will be sectors that will benefit by serving the prevailing demographic trend. Carefully monitoring these characteristics will provide investment opportunities throughout developed markets.

The Favorable Outlook for Emerging Market Investing

The brightest spot on the horizon is in Emerging Markets. Many emerging market economies enjoy positive demographic profiles in respect to age and middle class growth. Emerging market economies are demonstrating increased consumer spending as the middle class expands. Trends toward technological advancement and financial sector growth are also in evidence.

To illustrate, India recently replaced China as the most populated country in the world. The age of India’s population is also younger than China’s. A 6/10/24 MarketWatch article reported that India “saw the number of millionaires rocket more than 12% last year, far faster than any of its competitors.”[2]

There are over 47 stock markets that are included in the MSCI All Country World Index (23 Developed Markets and 24 Emerging Market countries). All these markets have regulatory oversight of their listed companies. Hemispheres owns market leading or high-quality companies, of which many adhere to international accounting standards; some companies even dually report their financial results using their domestic market accounting standards and U.S accounting standards (U.S. Generally Accepting Accounting Standards [GAAP]. Additionally, the world’s regulators often work together to coordinate reporting standards.

Diversification Benefits in Emerging Markets

The addition of Emerging Markets to investor portfolios provides diversification benefits. The MSCI Emerging Market index correlation to the S&P 500 is 0.62. Statistically, a correlation factor of 0.7 or less means that adding a asset class or an stock to a portfolio will improve diversification.

Kent Smetters, professor of business economics at the Wharton School of the University of Pennsylvania and a proponent of passive index investing, noted that value can be found in emerging markets. He wrote: “But in certain niche markets, like emerging-market .…where assets are less liquid and fewer people are watching, it is possible for an active manager to spot diamonds in the rough[3].” There are complexities and nuances associated with investing in various markets that require expert guidance. Hemispheres Investment Management’s team of seasoned professionals have a 35-year track record of successfully managing investment strategies with a deep proficiency in emerging market investing.

Conclusion

This article highlights the heightened challenges facing developed markets but also the enormous investment opportunities associated with investing in sectors that will benefit from demographic shifts and government policy changes to adapt to those shifts. Because of favorable demographic trends in emerging market countries, we see favorable investment opportunities in that asset class in particular.

We recognize that individual and institutional investors alike may be new to investing in Global Equities. There are complexities and nuances associated with investing in various markets that require expert guidance. Investing in Global Markets can provide both returns and diversification benefits to our clients. Hemispheres Investment Management’s team of seasoned professionals have a 35-year track record of successful investment strategies. The Global Equities product is Hemispheres flagship product.

Please contact Hemispheres Investment Management for a free consultation. We provide guidance and strategies to assist you optimize your investment policy and help you achieve your investment goals. Book a meeting

[1] Labor force and macroeconomic projections overview and highlights, 2022–32 : Monthly Labor Review: U.S. Bureau of Labor Statistics (bls.gov)

[2] Opinion: Every 15 minutes, there’s a new millionaire in this Asian country – MarketWatch