Introduction

Countries around the globe are adjusting monetary policy to compensate for decade high levels of inflation. This article will focus on US Federal Reserve policy which strongly influences both Hemispheres domestic as well as global equities investment strategies.

The Federal Reserve Monetary Policy

One of the tools the Federal Reserve utilizes in adjusting monetary policy is through interest rate adjustments. The Federal Reserve has been aggressively raising interest rates since last year in response to significant inflationary pressure. As noted in a previous report, earlier in the year we witnessed the effect of a change in monetary policy on the small banking sector. Some notable banks failed, others merged and most required access to increased borrowing through the Federal Reserve to stabilize them.

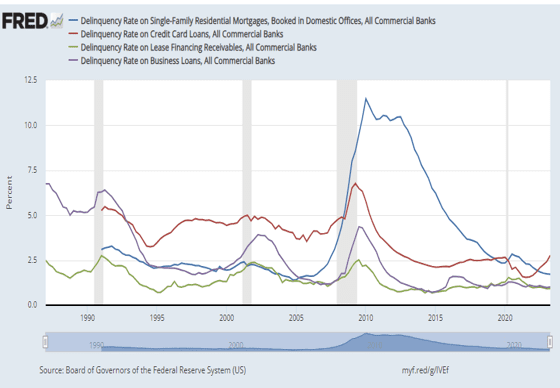

In June, the Federal Reserve Bank of St. Louis issued its semiannual report demonstrating an increase in credit card delinquencies to 2.7% for Commercial Banks of all sizes versus closer to 2% in late 2021. This increase in delinquencies is directly due to higher interest rates and it is occurring despite low unemployment levels. We should note that the credit card delinquency rate for the smaller banks is 7.5%, which is both significant and worrisome. While this level of delinquency does not compare with the levels seen following the 2009 recession, it does represent a trend reversal in the default cycle which had been improving until 2022.

Impact of Monetary Policy Tightening on the Government Budget

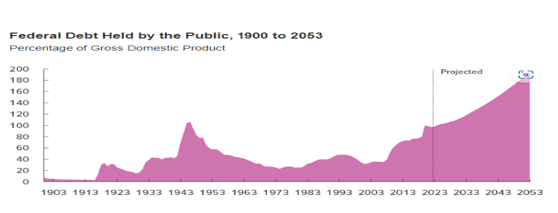

The following charts were prepared by the Congressional Budget Office (CBO) and represent both historical and projected data through 2033. As shown in the images below, the U.S. government operated with a budget surplus in the mid- to late 1990s but following the events surrounding 2001 and the financial crisis in 2009, Congress stimulated the economy utilizing, among other things, deficit spending with steadily increasing government borrowing. The Federal Reserve also adjusted monetary policy through record low interest rates to further stimulate economic growth.

Please note that the Primary Deficit listed in the image below is defined as government spending less interest payments while the Total Deficit includes interest payments. Both Images below provide the Congressional Budget Office’s projected levels of debt as a percentage of GDP between now and 2033 should interest rates remain at current levels for the entire period. The CBO notes that one of the primary drivers of the increase in debt burden is the higher interest rates, leading to additional borrowing.

Source: CBO Budget and Economic Outlook: 2023 to 2033

Source: CBO Budget and Economic Outlook: 2023 to 2033

Conclusion

The Federal Reserve has done a masterful job in raising interest rates to bring down inflation thus far. The stock market returns year-to-date have been outstanding and bond market yields are at multi-year highs. While this is true, the risk of a recession next year remains elevated. What is also clear, based on the information provided by the Federal Reserve Bank of St. Louis and the CBO projections, is that there will be significant pressure (self-imposed and otherwise) for the Federal Reserve to reduce rates as early as feasible to:

- Mitigate further worsening of the default cycle, for both consumer and business borrowers.

- To strengthen the banking sector, thus improving credit availability in the country.

- To slow the trajectory of growth in government debt.

Once again, we would indicate that Hemispheres Investment Management carefully selects high quality stocks and bonds that are trading below market value. By so doing, Hemispheres provides a margin of safety for our client’s portfolios. Furthermore, Hemispheres Investment Management is a global investment manager. Where the United States has close to 2,400 companies with a market capitalization greater than $1 billion for managers to invest in, globally there are over 10,000. As a result, we can choose securities that offer improved diversification and enhanced total return for our clients.

As always, we would be happy to discuss anything in this report or any other questions or concerns that you may have. Book a meeting

August 29, 2023

Rebecca Holden, CFA

Director of Domestic Research

818.970.1197

[email protected]

Michael Hart, CFA

CEO

310.993.1886

[email protected]

HEMISPHERES INVESTMENT MANAGEMENT

https://HEMISPHERESIM.COM