Introduction

Hemispheres Investment Management closely monitors inflation and monetary policy in the U.S. as well as for all of the countries that influence or holdings in the Global Equities Strategy.

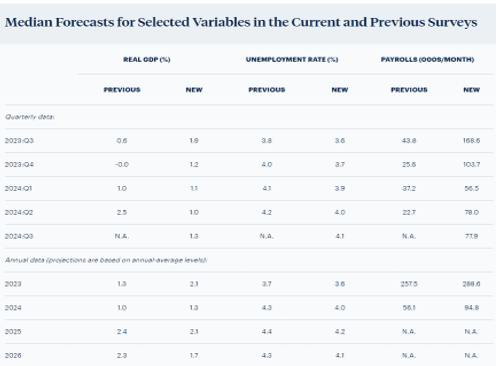

The Philadelphia Federal Reserve surveys 37 prominent economists and compiles a report known as the Survey of Professional Forecasters. The survey helps the Federal Open Market Committee (FOMC) determine economic growth, assess inflation and ultimately to set monetary policy. Most recently, the consensus predicted real GDP would grow at an annual rate of 1.9% for the Q32023. This represented an upward revision from the previous assessment of 0.6%. The quarter over quarter changes for the variables shown in the chart below demonstrate the difficulty formulating a forecast. This uncertainty led the FOMC to hold interest rates at current levels at the policy meeting concluded September 20, 2023.

Federal Reserve Responsibility to Balance Inflation, Growth and employment

The Federal Reserve Bank of St. Louis forecasts, the projected inflation level above the 2% target at least into 2025. The Federal Reserve has been delegated the responsibility, by Congress, to promote the effective operation of the US economy. Specifically, it is responsible for promoting maximum employment, minimizing inflation, and moderating long-term interest rates in the US economy. Additional responsibilities include: consumer protection, promote stability in the financial system in general and for individual financial institutions in particular.

Impact of Inflation and Higher Interest Rates on the Economy

Hemispheres anticipates that the Federal Reserve will need to allow targeted inflation to remain above the 2% goal to achieve ongoing economic growth for the following reasons:

- The banking system continues to see profitability declining. Banks are grappling with the imbalance between higher interest rates for deposits versus revenues from historically lower interest rate loans. Furthermore, as the economy slows, the default cycle is expected to rise, both for consumers and businesses. When economic growth slows, the banking sector tightens credit standards to protect against higher defaults rates. Tighter credit standards increase the difficulty in obtaining loans for all but borrowers with the best credit. The inability to access capital by would-be borrowers will slow growth in the economy. This projected outlook would pressure the Federal Reserve to be very careful when raising interest rates much further.

- Geopolitical politics are contributing to higher inflation and temporarily slowing economic growth. The U.S. and Europe are trying to build more reliable supply chains domestically. This is especially true with strategically critical technologies such as semiconductors.

- As global trade declines, the new trend toward regionalization will increase costs and sustain inflation as the efficiencies of globalization are lessened.

- Heavy investments to realign supply chains and counteract climate change will likely reduce investments that would produce economic growth in the short to intermediate term. Furthermore, lower expenditures to maintain oil supplies during the transition period, coupled with sustained oil demand may result in elevated oil prices, fueling higher inflation.

Conclusion

Geopolitical factors are beyond the mandate and control of the Federal Reserve. It is Hemispheres’ belief that the Federal Reserve will determine that it is more efficient to tolerate slightly higher inflation and in the intermediate to longer term, adopt a lower interest rate policy that is more favorable to the U.S. Government, given high debt level. Such a policy would be helpful to consumers, stabilize the banking sector and will promote economic growth.

For corporations, we conclude that industry leading companies with strong profitability, well managed balance sheets and positive cash flows will continue to thrive in this environment. Companies that historically have net operating losses and have depended on external financing to fund growth will not fare as well, and this will be reflected in stock prices.

As always, feel free to contact us with any questions that you may have. Book a meeting

Rebecca Holden, CFA

Michael Hart, CFA