Introduction to Interest Rate Movements

Interest rates are one of the most important factors affecting the economy and the outlook for asset class performance. When interest rates rise, borrowing costs increase, which can reduce consumer spending and business investment, leading to lower economic growth. Conversely, when interest rates fall, borrowing costs decrease, which can stimulate consumer spending and business investment, leading to higher growth.

Understanding the relationship between interest rates and stock market performance helps investors grasp how changes impact their portfolio. Astute investors allocate money to asset classes and individual stocks that will benefit from the interest rate change.

Theoretically when interest rates rise, stock prices should fall. This is for two reasons. First, higher interest rates can reduce an entity’s profits and cash flow. The impact of higher interest rates is most felt in companies that maintain higher debt burdens. Second, share prices are derived by discounting a company’s projected cash flow. The higher the interest rate the higher the discount rate used by analysts. The discount rate is the denominator of the calculation thereby yielding a lower stock price.

Bond prices are directly impacted by changing interest rates. There is an inverse relationship between interest rates and bond prices. While interest rate cycles generally move in tandem across the globe, the correlation and timing are imperfect. As such, Global Equities can offer unique benefits for an investor.

Federal Reserve Methodology to Adjust Money Supply

The Federal Reserve has a dual mandate, to set rates that maximize employment while ensuring price stability. The Federal Reserve implements monetary policy through its Federal Open Market Committee (FOMC). The FOMC sets a target range for the federal funds rate and then utilizes various monetary tools to move market interest rates toward the new target range. The federal funds rate target is set by the fed, but the actual rate is determined by the supply and demand for overnight loans in the interbank money market. This rate differs from the discount rate, which is the rate that the Federal Reserve charges a bank as a lender of last resort.

Since market participants are anticipating the FOMC to begin reducing interest rates in September, a reminder of the way the FOMC adjusts monetary policy might be useful.

Expansionary Monetary Policy

When the economy weakens, the FOMC can stimulate the economy starting with a reduction in the federal funds rate. Expansionary monetary policy affects the economy as follows:

- Lower interest rates reduce the cost of borrowing, encouraging consumers to spend more on goods and services and prompting businesses to invest in new equipment.

- Increased spending by consumers and businesses boosts overall demand for goods and services in the economy.

- As demand grows, businesses are likely to hire more employees and increase spending on other resources.

- These increases in spending spread throughout the economy, reducing unemployment and moving the economy toward maximum employment.

The Fed’s monetary policy tools effectively guide the economy back toward maximum employment when it faces weakness.

Contractionary Monetary Policy

When inflation consistently exceeds 2%, the FOMC can implement contractionary monetary policy. This approach aims to bring both actual and expected inflation back toward the target, ensuring price stability. Contractionary policy actions by the Fed affect the economy in the following ways:

- Higher interest rates increase the cost of borrowing, which discourages consumers from spending on certain goods and services and reduces business investment in new equipment.

- Reduced spending by consumers and businesses lowers overall demand for goods and services in the economy.

- With decreased demand, businesses are less likely to hire additional employees or invest in other resources.

- As these reductions in spending ripple through the economy, inflationary pressures diminish, and the inflation rate returns to around 2%.

The goal of contractionary monetary policy is to slow the rate of demand for goods and services, not to halt it entirely. By raising interest rates, contractionary policy helps dampen inflation and guides the economy back toward the price stability component of the dual mandate.

Understanding the Impact of Interest Rates on Investments

Economic Indicators that Influence FOMC action

Real GDP

Real GDP measures the value of goods and services produced in the US before inflationary increases in purchasing power. In addition to the absolute number, the stock market reacts to the percentage change versus the previous quarter and revisions to forecasts.

Nonfarm payrolls and the unemployment rate

Nonfarm payrolls and the unemployment rate are crucial indicators of economic health and have a significant impact on securities markets. When businesses hire more employees, market participants often see this as a sign of strong business performance, which can lead to expectations of increased consumer spending. Conversely, a rising unemployment rate—or even a smaller-than-expected decline—can be linked to falling stock prices, as it might indicate that financially strained employers are cutting back.

Price Indexes (CPI and PPI)

The Consumer Price Index (CPI) is a monthly measure of the prices of a basket of goods and services commonly purchased by urban consumers, including food, transportation, clothing, and medical care. The CPI helps economists gauge inflation by tracking increases in the general price of goods and services in the U.S.

The Producer Price Index (PPI) measures price changes from the perspective of sellers by tracking the sale prices received by domestic producers of goods and services. The PPI is broader than the CPI. The index tracks price changes across nearly all industries in the goods-producing sectors of the U.S. economy.

Consumer Confidence

There are two different entities that provide consumer confidence data. Increases in consumer confidence can be associated with rising share prices, as confident consumers are likely to spend more, stimulating economic growth and potentially leading to stronger corporate earnings.

Retail Sales

The retail sales report measures all sales by U.S companies. Changes in retail sales can directly affect the stock market, especially the retail sector. Higher sales indicate increased consumer spending, which tends to boost company performance, while lower sales suggest the opposite.

Durable goods

Durable goods orders are an indicator of manufacturing activity. “Durable goods” refers to consumer products that typically aren’t replaced for at least three years, such as large appliances and cars. An increase in durable goods orders usually signals economic health and can be associated with rising stock indices, while a decline may indicate economic trouble.

Impact of Interest Rates on Different Asset Classes

Stocks

In 2022, as inflation flared in the US economy and the interest rate hiking cycle began, stock market performance was adversely impacted. As the trend in inflation steadily declined and expectations of lower interest rates heightened, combined with an economic “soft-landing” thesis, stock performance improved. Still, the primary driver for equity performance in recent years has been large cap technology companies. The Magnificent 7 contributed most of the index gains and debt represents a relatively small amount of capital structure for these entities. Therefore, the seven tech companies have lower sensitivity to interest rates. Smaller capitalization companies, especially growth stocks, rely heavily on borrowing to fund growth. Therefore, the relative impact on smaller cap companies was greater. Evaluation of the S&P 500 equal weighted index to the cap weighted indices reflects the return differentials.

| Returns | S&P Equal Weight (RSP) | S&P 500 | Russell 2000 |

| Year-To-Date | 9.63% | 16.70% | 12.13% |

| 1 Year | 12.62% | 22.15% | 14.22% |

| 3 Year | 5.73% | 9.60% | 1.79% |

| 5 Year | 11.53% | 15.00% | 8.83% |

| 10 Year | 10.51% | 13.15% | 8.69% |

As seen in the 3-year performance numbers, the small cap Russell 2000 was most adversely impacted by higher interest rates. Year-to-date 2024, as expectation for interest rates to move lower, the Russell 2000 is outperforming the S&P 500 equal weighted index.

Bonds

When interest rates rise, bond prices tend to fall, and vice versa. For many years when interest rates were static at historically low values, bonds were not a good investment choice. This was especially true for retired individuals living on a fixed income as the coupons (interest payments) were based on the same low interest rates. In recent months, with higher interest rates (and therefore coupons) the asset class became appealing. Lower inflation numbers have raised the probability of rate cuts, making bonds an attractive investment alternative.

Residential Real Estate

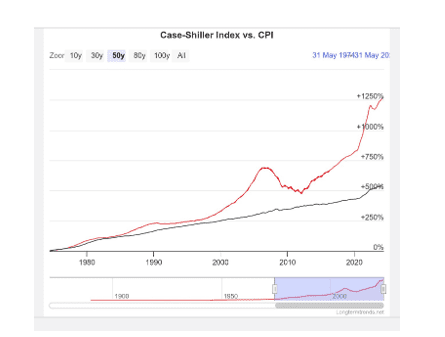

As an asset class, residential real estate returns have been meteoric. Demand that outstripped supply led to competitive bidding to achieve a winning contract. Higher interest rates make it more difficult for buyers to qualify for a loan, yet the supply problem persists. As a result, the classic inverse relationship between home prices and interest rates has not held. Further complicating the residential real estate market fundamentals is the historically low interest rates following 2009 that allowed buyers to lock in very low fixed rate loans. The homeowners are either locked into their current residence or must face the prospect of buying a new home at much higher interest rates.

Source: Cash Shiller

The above referenced Case-Shiller Real Estate Index vs. CPI demonstrates how expensive current real estate prices are relative to historical average. Despite this historic relationship, the supply/demand imbalance will likely result in elevated prices for some time. Bank data does demonstrate that higher interest mortgage delinquencies are beginning to increase. This represents a small proportion of overall mortgages outstanding however and unlikely to move markets. This forecast would change in the event of a deep recession with widespread unemployment.

Commercial Real Estate

Hemispheres Investment Management foresees continued difficulty in the commercial real estate sector. Transaction flow in commercial real estate has been exceptionally low since 2022 when interest rates were much lower. Therefore, even if the Federal Reserve lowers interest rates by 25 or 50 basis points the economics on these properties are financially stressed for the foreseeable future. Additionally, occupancy rates in office remain elevated on what appears to be a secular basis. A consolidation in the industry would benefit the asset class.

Asset Class Strategies in Response to Interest Rates

Stocks

In a rising interest rate environment or in a recession, increase allocation to large cap stocks. In a recession scenario, investors may want to allocate to defensive sector stocks such as health care, utilities and consumer staples. Furthermore, International and Global Equities may benefit from healthier economic conditions outside the US.

In a healthy economy with reducing interest rates (or the prospect of lower rates), increase allocation to small cap stocks. In a recession, small cap stocks will underperform.

Bonds

When interest rates are rising, shortening of bond duration is advisable. Shorter duration bonds do not lose as much value as a longer duration bond when rates increase. Duration measures how long it takes, in years, for an investor to be repaid a bond’s price through its total cash flows. The longer the duration, the more sensitive the bond is to changing interest rates. When interest rates are anticipated to decline, a longer duration bond would be indicated, all other things being equal (credit quality, etc.).

Conclusion

Hemispheres Investment Management’s team of seasoned professionals have a 35-year track-record of successful investment strategies garnered over many different economic cycles and interest rate environments. Hemispheres’ operating performance demonstrates deep proficiency investing in US, international developed and emerging markets. Hemispheres can assist you customize a portfolio to meet your individual needs as well as to diversify your investments. The Global Equities product is Hemispheres flagship product.

Long-term investment approaches tend to outperform going to cash in adverse market conditions because market timing has proven unsuccessful. Based upon the Kenneth R French data library, equity only strategies earned an average return of 10.68% versus 3.68% for cash only between 1926 – 2023. This data encompasses all recessions and all interest environments.

Please contact Hemispheres Investment Management for a free consultation. We provide guidance and strategies to assist you optimize your investment policy and help you achieve your investment goals. Book a meeting.