Q2 2024 Market Commentary

It’s Up-Up and Away!

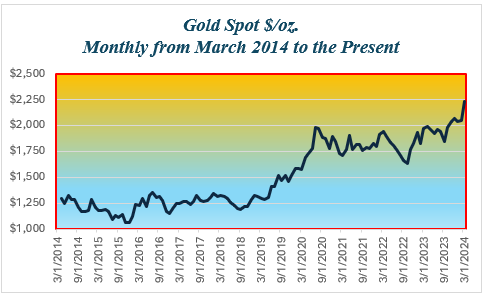

Gold Advancing

Golds’ recent ascent to over $2,300 signals a combination of fundamental factors. These include: the anticipation of lower interest rates, continued inflationary pressures and global political turbulence. Comments by U.S. Federal Reserve officials indicate a desire to cut interest rates at some point this year. The exact timing and the number of cuts is unknown, but the direction of yields is likely down.

The anticipated decline in rates is putting upward pressure on gold, which is positive for gold equities, including gold ETFs. Hemispheres, prefers owning individual companies versus Exchange Traded Funds. Hemispheres Global Equities strategy is to hold positions in leading gold equities that have substantial gold reserves such as Newmont Mining. Clients also own miners that are in the process of developing their ore body for eventual production. Such companies have large proven and probable reserves and often the ore body is polymetallic – the ore contains both gold, copper, and other industrial metals.

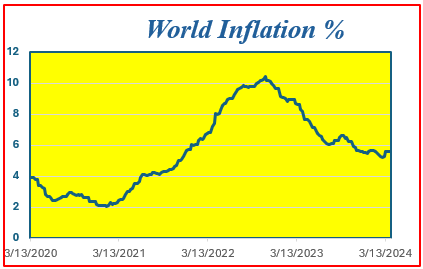

Gold and Inflation

Global inflation has declined precipitously from about 10% in 2022 to the current level of 5.5%, per Bloomberg[1]. Global Consumer Price Index (CPI) is a Bloomberg calculation based on the most recent CPI year-on-year reading for each country. The calculation includes its corresponding weight in global GDP on a purchasing power parity basis, using IMF data. At the beginning of the decade, world inflation was in the 2% to 4% range. Then the Ukraine-Russia war shocked the global economy and the world’s supply chain system and inflation rose sharply. After peaking in November 2022, inflation declined precipitously. Now it appears that world inflation is starting to level out near 6%. With inflation apparently settling at a much higher rate compared to 2020 and 2021, upward pressure on the price of gold has increased in conjunction with higher world inflation.

Gold and Politics

In a short period of time, the world’s geopolitical landscape has changed dramatically, unequivocally becoming more precarious and uncertain. Conflicts in Eastern Europe and the Middle East, U.S. and China trade wars and the rise of autocrats are causing political distress. With all this uncertainty, gold, as a historical store of value, provides protection against chaotic and stressful situations. With many political problems appearing to not have short-term resolutions, holding gold is a financial protection against this unfortunate political environment.

Conclusion

Hemispheres Investment Management’s principals have over 35+ years successfully managing client funds through multiple market cycles and various watershed events. We would be happy to offer you a free consultation. Book a meeting

[1] Bloomberg, April 9, 2024.