Domestic equity strategies offer investors exposure to U.S. stock markets, often a key part of a well-diversified portfolio. These strategies focus on U.S.-based companies, but they vary significantly in their approaches, ranging from growth and value stocks to small-cap and large-cap investments. Understanding these strategies is crucial, especially when economic factors, such as rising interest rates and inflation, can create uncertainty. In this article, we will address the most frequently asked questions regarding domestic equity strategies and provide insights on how investors can navigate this space.

What Are Domestic Equity Strategies?

Domestic equity strategies refer to investment approaches that focus on U.S.-based companies. These strategies aim to generate returns by investing in U.S. stocks, which represent a broad range of sectors, company sizes, and investment styles. Investors typically engage in domestic equity strategies to capitalize on the potential growth of U.S. markets while managing risk through diversification within the domestic market.

Popular domestic equity styles include:

- Value strategies target companies trading at a discount to their intrinsic value.

- Income strategies, focusing on dividend-paying stocks for steady returns.

- Growth strategies, which focus on companies expected to grow faster than the market average. These stocks generally do not pay a dividend and the size ranges from small companies to giant technology companies.

How Do Domestic Equity Strategies Perform Compared to Global Equities?

Investors often compare domestic equity strategies with global equity strategies to assess whether focusing solely on U.S. companies offers sufficient returns. Global equity portfolios include securities from both the United States and international stock markets. In fact, of the Morgan Stanley Capital International (MSCI) All Country World Index (MSCI ACWI) has a U.S. market weighting of 63.2%.

| S&P 500 | MSCI ACWI | MSCI Emerging Markets | |

| 12/31/1987 – 12/31/2023 | 10.91% | 7.65% | 8.81% |

U.S. equities have outperformed global equities over the 36-year period shown above. However, global equities offer significant diversification benefits. Global diversification helps reduce the risk of overexposure to a single country’s economic conditions.

During market downturns or periods of economic instability, global equities can provide a hedge against U.S.-centric risks. For example, during the COVID-19 pandemic, U.S. tech stocks outperformed, but global stocks in sectors like energy and materials demonstrated strong returns as economies reopened.

What Role Do Small-Cap vs. Large-Cap Stocks Play in Domestic Equity Strategies?

Small-cap and large-cap stocks represent two different types of companies based on their market capitalization. Small-cap stocks typically have a market value between $300 million and $2 billion, while large-cap stocks exceed $10 billion in market value. Each plays a unique role in domestic equity strategies.

- Small-cap stocks often tend to offer higher growth potential but come with more volatility and risk. These companies often have room for expansion and can be more agile, but they may also be more vulnerable to economic fluctuations. An investor needs to carefully analyze why the company’s capitalization is small. Remember, capitalization is simply the number of shares outstanding multiplied by the stock price. If the stock price is very low because the company is in a late cycle of operation (selling buggy whips for example), investors want to avoid those issues. If the company is offering new and promising products or technologies, the securities could be quite attractive.

- Large-cap stocks are usually more stable, established companies with a long track record of performance. They often pay dividends and provide more security during market downturns.

Balancing small-cap and large-cap stocks within a portfolio can help achieve both growth and stability. More important than capital size however are the financial fundamentals of the specific firm. Solid financial fundamentals are a key to success in riding out volatile markets. We would add another important caveat that valuations become critical at cyclical tops and bottoms. One important risk management tool Hemispheres utilizes is to buy discounted securities that tend to decline less in a bear market than a richly valued security.

Are Domestic Equity Strategies Still Relevant During Economic Uncertainty?

Yes, because domestic equities make up over 63% of the global investable stock market, domestic equity strategies remain relevant even during times of economic uncertainty. You can employ several highly relevant strategies to protect your portfolio during these periods.

Key factors to consider include:

Maintaining a long-term perspective:

On October 31, 2007, the stock market peaked, and markets declined through March of 2009. This decline represented the greatest financial crisis of a generation. The Nasdaq composite declined 55.8% during these months. Many individual investors panicked and sold their stock holdings at or near the cyclical bottom. For patient investors, who held their positions, the Nasdaq composite recovered 100% of losses in a little over 2 years from the market bottom. Worse still, many of those who lost capital were slow to reenter the market thereby suffering an opportunity loss.

A recent article published by Motley Fool Wealth Management discussed the adverse consequence of market timing:

“When you try to time the market by selling when it’s falling with the notion that you’ll get back it when it rises again, you’ll likely miss the best days of the market. Because the market turns quickly. In fact, over the last 20 years, from January 1, 2004, to December 29, 2023, six of the seven best days occurred after the worst days and seven of the best 10 days fell within two weeks of the 10 worst days within that two-decade period.

So what happens if you sell and miss those best days? Your potential return can fall dramatically. For example, over the last 20 years, if you stayed fully invested in an S&P 500 Index fund, your money should have grown by 9.8% [annual return]. But what if you sold during a market downturn and then missed those 10 best days, your portfolio would be less than half of that—just 5.6%. And missing the best 20 days would cut your return by more than 70%”[1]

Diversification:

Portfolio Diversification is a capital preservation strategy that attempts to reduce overall portfolio volatility. Diversification limits exposure to any single asset within a portfolio by allocating capital to a mix of various investments. “Don’t put all of your eggs in one basket” is an age-old idea that continues to be true today. Individuals can diversify their portfolios by investing in various asset classes like US stocks, global equities, domestic bonds, global bonds, real estate, or other alternative investment vehicles. Alternate investments include items such as exchange traded funds, cryptocurrency, commodities, cash, and cash equivalents, etc. You can also achieve diversification by spreading your investments across various investment styles or strategies, sector rotation, and market capitalization.

You achieve portfolio diversification by evaluating ‘correlation coefficients’ within a single asset class. Correlation coefficients highlight the relative movements of various investment opportunities, whether they move in the same direction or not, and the degree to which they move. Through the addition of securities with low, or even negative correlation coefficients, positive performance of some investments offsets the negative performance of others. By doing so, you smooth investment returns, provide a more consistent level of portfolio performance for investors, and demonstrate it as a risk management method. For more information on strategic diversification and risk management, please refer to our article dated March 18, 2024.[2]

What Sectors Should I Focus on Within Domestic Equity Portfolios?

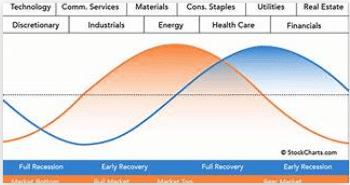

Investors can target specific sectors based on economic conditions and long-term trends. As a practical matter, selecting specific sectors to overweight is neither easy nor a guaranteed effective strategy. Historically and as a rule of thumb analysts referred to a chart like the image below. The blue line represents the economic cycle, and the orange line represents the stock market cycle.

The difficulty that we face is twofold. Technology is changing rapidly, and many sectors adopt and are affected by these changes leading to cyclical shifts. Second, policies in respect to such things as climate change with its accompanying financial incentives have changed the cyclicality of sectors such as the energy and utility sectors. Second, being able to predict the exact location in the economic cycle is highly complex and data dependent. The government can change the trajectory, timing and duration of the economic cycle with a combination of monetary and fiscal policy.

Hemispheres Investment Management is a bottom up, research driven value manager. One commonly utilized sector rotation strategy is based upon valuation metrics and is consistent with Hemispheres’ value approach to investing. When value exists in multiple stocks within a certain sector, Hemispheres may choose to overweight the sector.

Hemispheres evaluates metrics such as price to earnings, price to book value, dividend yield, price to economic value and others. Fundamental analysis in conjunction with valuation metrics determines fair market value. The large number of companies in the technology sector heavily weights the Russell 3000 toward that sector. You can find significant opportunities in many other sectors with less representation in the index, which can boost investor returns.

How Do Growth and Value Stocks Differ in Domestic Equity Strategies?

Growth and value stocks represent two primary investment styles within domestic equity strategies, each with distinct characteristics:

Growth stocks:

Growth stocks are companies expected to grow faster than the overall market. They typically reinvest profits to fuel further growth, making them appealing to investors seeking capital appreciation. Sectors like technology and healthcare often contain high-growth companies. These sectors have performed very well, especially in the first half of 2024. Many stock valuations are very extended following months of outperformance. As the economy demonstrated signs of slowing, many of these shares have led the market lower during the recent sell-off. While opportunity could very well exist in these companies in the future, in recent months buy-the-dip investors have not experienced a successful outcome.

Value stocks

Value stocks are companies trading at prices lower than their intrinsic value. These companies may be temporarily out of favor but are expected to recover over time. You can achieve outperformance as these discounted stocks re-rate to their fair market value. Value investors often look for stocks with strong fundamentals but relatively low price-to-earnings ratios.

Both styles have cycles of outperformance, and balancing growth and value can help manage risk. For example, growth stocks may outperform during bull markets, while value stocks often provide stability during market downturns.

How Does the Fed’s Monetary Policy Impact Domestic Equity Returns?

The Federal Reserve’s monetary policy, particularly changes in interest rates, has a significant impact on domestic equity returns. When the Fed raises interest rates, borrowing costs increase, potentially slowing economic growth and reducing corporate profits. This can lead to lower stock prices, especially for growth-oriented companies that rely on cheap capital for expansion.

Conversely, when the Fed lowers interest rates, borrowing becomes cheaper, stimulating economic activity and often driving stock prices higher. Sectors like financials, which benefit from higher interest margins, may outperform when rates rise, while technology stocks, particularly those companies that carry debt, typically perform better in low-interest-rate environments.

What Are the Tax Implications of Domestic Equity Investments?

Domestic equity investments come with various tax considerations, particularly regarding dividends and capital gains. Understanding these tax implications is important for optimizing after-tax returns. Key factors include:

Dividends:

Many domestic stocks, especially large-cap and dividend-paying stocks, generate regular dividend income. Tax-conscious investors find qualified dividends attractive because they are taxed at a lower rate compared to ordinary income. The IRS considers a dividend qualified if it meets specific guidelines. Generally, if the shareholder held a stock for more than 60 days in a 121-day period it is qualified. The holding period needs to begin 60 days before the ex-dividend date.

Capital gains:

The sale of securities can generate capital gains, which are taxed based on the holding period. For assets held longer than one year, investors receive a favorable, long-term capital gains rate. Securities held and sold before in less than one year are taxed at ordinary income rates.

Effective tax planning, including the use of tax-advantaged accounts such as IRAs, can help minimize the tax burden on domestic equity investments.

What Is the Outlook for U.S. Stocks in the Next 12-18 Months?

The outlook for U.S. stocks in the next year or so depends on several factors, including Federal Reserve policy, US government fiscal policy, inflation trends, global economic and geopolitical conditions. While some analysts anticipate potential slowdowns or mild recessions, many also believe the U.S. economy could continue to grow, albeit at a slower pace.

With inflation expected to gradually decline, interest rate cuts could provide a tailwind for equities.

Conclusion

Domestic equity strategies remain a core component of many investment portfolios, offering exposure to the world’s largest and most dynamic economy. Understanding the nuances of these strategies—including the differences between growth and value stocks, small-cap and large-cap investments, and sector-based opportunities—can help investors optimize their portfolios for both growth and stability. While economic uncertainty may create short-term challenges, the long-term prospects for U.S. equities remain promising.

Balancing capital preservation strategies with capital growth during periods of volatility cannot be understated. Hemispheres has a consistent, repeatable approach to investing that has proven successful over many years. Hemispheres Investment Management utilizes multiple risk mitigation strategies on an ongoing basis. A market sell-off becomes an opportunity to add to positions and sectors.

We recognize that individual and institutional investors alike may benefit through expert guidance. Hemispheres Investment Management’s team of seasoned professionals have a 35-year track record of successful investment strategies in Domestic Equities, Global Equities and Fixed Income management.

Please contact Hemispheres Investment Management for a free consultation. We provide guidance and strategies to assist you optimize your investment policy and help you achieve your investment goals. Book a meeting

[1] timing-the-market.pdf (foolwealth.com)

[2] Strategic Diversification in Global Equities Investing (hemispheresim.com)