Introduction

Hemispheres Investment Management is a value manager whose leading product is the Global Equities strategy. The purpose of this article today is to discuss the differences between value and growth investment styles. It is also to demonstrate the historical relationship between the two strategies.

Historical relationship between Value Investing and Growth Investing

1 http://mba.tuck.dartmouth.edu/pages/faculty/ken.french/index.html

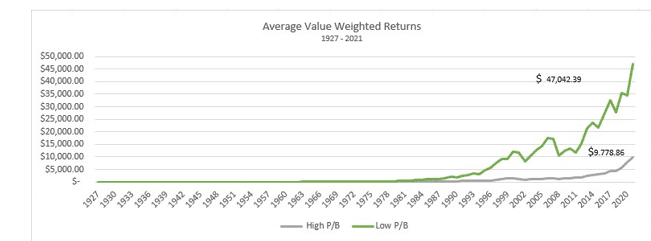

From December 1926 to December 2022, the chart pictured above, compares returns of low price to book (value companies) with high price to book companies (growth companies), assuming a $1 initial investment in each. Despite the popularity and outperformance of growth stocks since 2009, the article will elucidate the variances in investment strategies and why Hemispheres Investment Management prioritizes value-focused investing.

Value investing involves buying stocks below intrinsic value using metrics like price-to-book value, earnings multiples, and high dividend yields. The discount of the market price to the intrinsic value is what Benjamin Graham called the “margin of safety.” Hemispheres Investment Management analyzes these metrics, along with factors like earnings stability, asset quality, debt burden and market competition. The firm purchases high-quality companies at discounted prices.

Growth companies, often richly valued, aim for higher-than-average market growth. They reinvest cash flow for expansion, banking on unique products for success. However, these products and services may or may not result in long-term success. Since 2007, growth companies relied heavily on external financing due to low interest rates, inflation, and Fed quantitative easing policies, leading to speculative bubbles.

Case Study: Rivian Automotive

Evaluating Rivian Automotive, Inc. (RIVN), an electric car manufacturer, highlights the challenge of pricing growth stocks. In November 2021, RIVN traded at $172/share, valuing it over $150 billion. Despite revenue of $55k and a $4.2 billion loss in 2021, RIVN’s market valuation exceeded General Motors (GM) at $89 billion, with $10 billion in profits and a positive outlook. By 2025, RIVN is forecasted to lose $3.1 billion annually. RIVN, a growth stock, plummeted to $21/share, showcasing the volatility of growth stocks against value investing amid changing interest rates and fundamentals. The poor 2022 investment performance of growth stocks relative to value investing demonstrated what happens when interest rates start to normalize, and fundamentals reconnect with price discovery.

Conclusion

With the Federal Reserve’s efforts to combat inflation by raising rates and adopting quantitative tightening, credit to individuals and corporations from banks is tightening. Investing in entities with a “margin of safety” is now more critical than ever.

By investing globally, we offer our clients the ability to diversify their portfolio by sector as well as by country, all while investing in leading/high quality companies at a discount to their intrinsic value. We would be happy to assist you with your investment needs. Book a meeting

Rebecca Holden, CFA

rholden@hemispheresim.com

Michael Hart, CFA

February 3, 2023