Introduction

Electric Vehicle (EV) sales began to slow in the US during the second half of 2023. As a result, General Motors and Ford announced delays in planned investment for Electric Vehicle and Battery production capacity. The reduced production does not bode well for the adoption of the rule, proposed in May 2023, by the Environmental Protection Agency (EPA) that would require 60% of new light and medium duty vehicles sold in the US to be EVs by 2030, 67.5% by 2032 and 100% by 2035. The finalized EPA proposed rule is due by July 2024.

The production slowdown occurred despite Federal and, in some cases, State incentives to purchase Electric Vehicles. From a consumer’s perspective, the rationale behind the hesitation is multifaceted and includes:

- The high cost of an Electric Vehicle relative to Internal Combustion Engine Vehicles (ICEV).

- Higher monthly payments associated with higher interest rates.

- The uncertainty regarding the ability to locate charging stations when needed.

- The relatively short-range capability of an electric vehicle (especially in cold weather that further reduces range.

- Time to charge the EV compared to the time to fill up an ICEV at the gas pump.

- Confusion related to the rule change regarding the availability of the Federal Tax Credit.

Federal Tax Credit Rules For EVs

In 2023 The Federal Government gave up to a $7,500 tax credit to eligible buyers under specific conditions. The conditions included:

- The electric vehicle final assembly must be in the US.

- The battery must have 50% of its components manufactured or assembled in the US. The standard increases by 10% per annum reaching 100% by 2029.

- Chinese companies must own less than 25% of a battery-parts producer to avoid disqualifying the vehicle.

- Regarding the critical battery minerals, one of two conditions must be met. First, the critical battery minerals must be extracted and processed in the US. Alternatively, the minerals must be sourced in a country that has a free trade agreement with the US.

- For a single filing taxpayer income must be $150,000 or less. For joint filing taxpayer’s income must be $300,000 or less.

- Only automobiles costing less than $55,000 and trucks/SUV under $80,000 are eligible for the credit.

Failure to meet the standards resulted in a reduction or elimination of the tax credit. A prospective buyer often was not knowledgeable of vehicle and/or battery component source and assembly locations. The confusion could be costly. In early 2024, the tax credit was eliminated but due to continued slowing sales, the government is reassessing the tax credit once again.

Cost of an Electric Vehicle – Purchase Price

According to JD Power and Associates data, American Car buyers paid an average of $51,668 for a new electric vehicle in November 2023, compared to $44,112 for an ICEV. This difference in price to consumers seems negligible, especially when considering the maintenance and fueling expenses associated with an ICEV versus the electric vehicle. However, the price and cost estimates ignore enormous government subsidies to the manufacturers that are ultimately born by the US taxpayer.

An analysis performed by Brent Bennett and Jason Isaac of the Texas Public Policy Foundation, published in October 2023, identified the total cost, many of these hidden costs to US taxpayers, of adoption of electric vehicle technology. These costs are based on the current US electric vehicle market share of 8% and projects an increase in these costs when market share increases. Besides the direct state and federal subsidies the electric vehicle buyers receive, the manufacturers in 2021 received nearly $22 billion tax credits to subsidize the retail price of the EV to the ultimate buyer.

Social Cost of Operating an Electric Vehicle

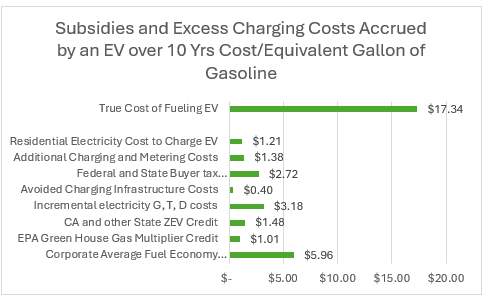

The Texas Public Policy Foundation website excerpt shown below compares the operation of the EV on a gallon of gas equivalent basis. The EPA provides automobile manufacturers with an EV credit for federal fuel efficiency standards and separate credits for zero greenhouse gas emissions. Together, these credits provided an estimated $27,900 benefit per vehicle for the auto manufacturer.

Also factored into the cost estimate is the added cost required to expand electric generation, transmission, and distribution to meet the increased electrical demand that home and public charging stations will necessitate. The report suggests that an average of $11,933 in socialized costs per electric vehicle will be assumed by utility rate payers and taxpayers over a 10-year period for increased electric capacity. Given these costs, the report concludes that the subsidies and excess charging costs accrued by an EV over 10 years, expressed in terms of cost per equivalent gallon of gasoline is $17.34. Clearly, this is significantly higher than a gallon of gasoline in today’s market albeit paid by the US taxpayer and utility rate base versus the electric vehicle buyer.

Other Factors Complicating Electric Vehicle adoption

Politics

Given the high cost of the technology adoption, combined with the large oil reserves in the US, there are conflicting and very strong opposing interests for policy makers to consider. We should note that investment in oil reserve development has been very low in this country given the political environment and that at some point soon, demand may very well outstrip supply, resulting in sharp increases in oil prices.

Market fundamentals for Electric Vehicle Charging Companies

Despite large government subsidies and huge investments by the major auto manufactures ($5 Billion to date) and other investors, most of the publicly traded charging station companies operate at large losses. Stock prices during 2023 declined significantly for many of these companies (CHPT down 74%, BLNK down 67%, EVGO down 21%). Limited capital availability to add charging stations could result without further government inducement.

Geopolitical Factors

- China utilizes high CO2 emitting power stations to operate EV manufacturing and battery component mining and refining. China is striving to remedy this issue, however European countries and the US are contemplating increasing tariffs. Tariffs will only increase the cost of the EV.

- Many mineral rich countries provide a significant supply of necessary metals and minerals to produce batteries. Unfortunately, many of these also have dangerous labor conditions that make economically supporting these regimes morally untenable.

- Opening a mine in the US could take longer than 25 years to gain permitting and EPA approvals.

Avoiding these markets further increases the costs of battery production which ultimately makes the EV more expensive.

Financial Condition of startup Electric Vehicle and battery manufacturers

According to the WSJ article written by Amrith Ramkumar and Shane Shifflett on 12/19/2023 entitled “These Tesla Wannabes Are Running out of Road,” “At least 18 EV and battery startups that went public in recent years were at risk of running out of cash by the end of 2024 as of their most recent financial filings.” Three additional companies have already filed for bankruptcy. The article reports the median stock among companies that the WSJ followed declined 80% from its market debut. Participation by potential investors would require a capital infusion and a change in market trend.

US consumers demand for SUVs and Trucks versus smaller cars represents a problem for Electric Vehicle adoption

Large EVs require large batteries comprised of heavy and rare metals and minerals where supply constraints currently exist. Larger cars have a greater range, however the cost is high (even with the subsidy and tax credit). Furthermore, the batteries only have a useful life of 12 years on average. It is in the government interest to encourage smaller EV demand.

The environmental impact and economic benefit of a hybrid as opposed to fully Electric Vehicle

In an article written by T McParland in May of 2023 we learn: “Despite the massive financial and regulatory advantages being offered to EVs, there are greater than four times more hybrid and plug-in hybrid vehicles than full EVs registered in the U.S. Toyota estimated that the number of materials to make one EV battery can make 90 hybrid batteries and that those 90 hybrids will cause 37 times more emissions reductions over their lifetime than one EV. Perhaps if D.C. politicians and bureaucrats stop trying to force Americans to build and buy their preferred types of vehicles, the cleaner and brighter future that they imagine will actually materialize”.[1]

Funding Issues

The Infrastructure Investment and Jobs Act, combined with the Inflation Reduction Act propose to invest approximately $210 Billion for EV projects by 2030. Unfortunately, these projects are being delayed, often because of conflicting governmental policies and early-stage technology inadequacies. Furthermore, the government is hoping that much of the expense can be assumed by private investors. Unless these projects are completed in a timely manner, the probability that the infrastructure can be in place to make EVs a reasonable alternative for the American consumer by the EPA imposed deadlines appears unlikely at this time.

Conclusion

Clean Energy is a world-wide priority. Government and private capital investment continue to promote low emission technologies in the automotive, and other industries. Hemispheres evaluates the supply, demand and economics of the technology adoption. Hemispheres is a bottom up manager that performs extensive analysis on the companies it adds to client portfolios.

There are complexities and nuances associated with investing in various markets that require expert guidance. Hemispheres Investment Management’s team of seasoned professionals have a 35-year track record of successful investment strategies. Hemispheres flagship product is its Global Equities Strategy.

Please contact Hemispheres Investment Management for a free consultation. We offer individualized guidance and strategies that can help you to meet your financial objectives. Book a meeting

Please feel free to contact us with questions or comments.

[1] McParland, T. (2023, May 17). This is why Toyota isn’t rushing to sell you an electric vehicle. Jalopnik. https://jalopnik.com/ toyota-focusing-on-hybrids-not-electric-vehicles-1850440908