Cybersecurity: A Growing Challenge

The digital age has ushered in a new era of connectivity and convenience. However, it has also brought forth a significant challenge: cybersecurity. As technology advances, so do the tactics employed by cybercriminals. This has made cybersecurity a critical concern for individuals, businesses and governments alike. The Evolving Landscape Cyberattacks have become increasingly sophisticated and […]

Read MoreNavigating the Electric Vehicle Landscape: A Complex Road Ahead

EV Trends Since January 2024 In our January 2024 article entitled, “Challenges in Transitioning to An Electric Vehicle (EV) World” we outlined the specifics behind government subsidies, the various costs of ownership, including the social costs and the multiple factors that complicated adoption of the electric vehicle technology. This article provides a year end update […]

Read MoreSupply Chain Disruptions: A Double-Edged Sword

The Impact of Geopolitical Tensions on Global Supply Chains Geopolitical tensions have cast a long shadow over global supply chains, exacerbating existing vulnerabilities and creating new challenges. Trade wars, sanctions, and political instability have disrupted the flow of goods and services, leading to increased costs, delayed shipments, and product shortages. Key Risk Factors Driving Supply […]

Read MoreHealthcare Innovation: A Technological Revolution Assisted by Artificial Intelligence

Introduction The healthcare industry is undergoing a profound transformation, driven by groundbreaking advancements in biotechnology, medical devices, and healthcare technology. These innovations are not only improving patient outcomes but also creating significant investment opportunities. At the forefront of this revolution is artificial intelligence (AI), which plays a pivotal role in reshaping the way we approach […]

Read MoreInfrastructure Investments: A Solid Foundation for the Future

Infrastructure, the backbone of any economy, plays a crucial role in driving economic growth, improving quality of life, and fostering innovation. From roads and bridges to power plants and telecommunications networks, infrastructure investments are essential for the long-term development of a nation. The Importance of Infrastructure in Economic Growth A robust infrastructure network is vital […]

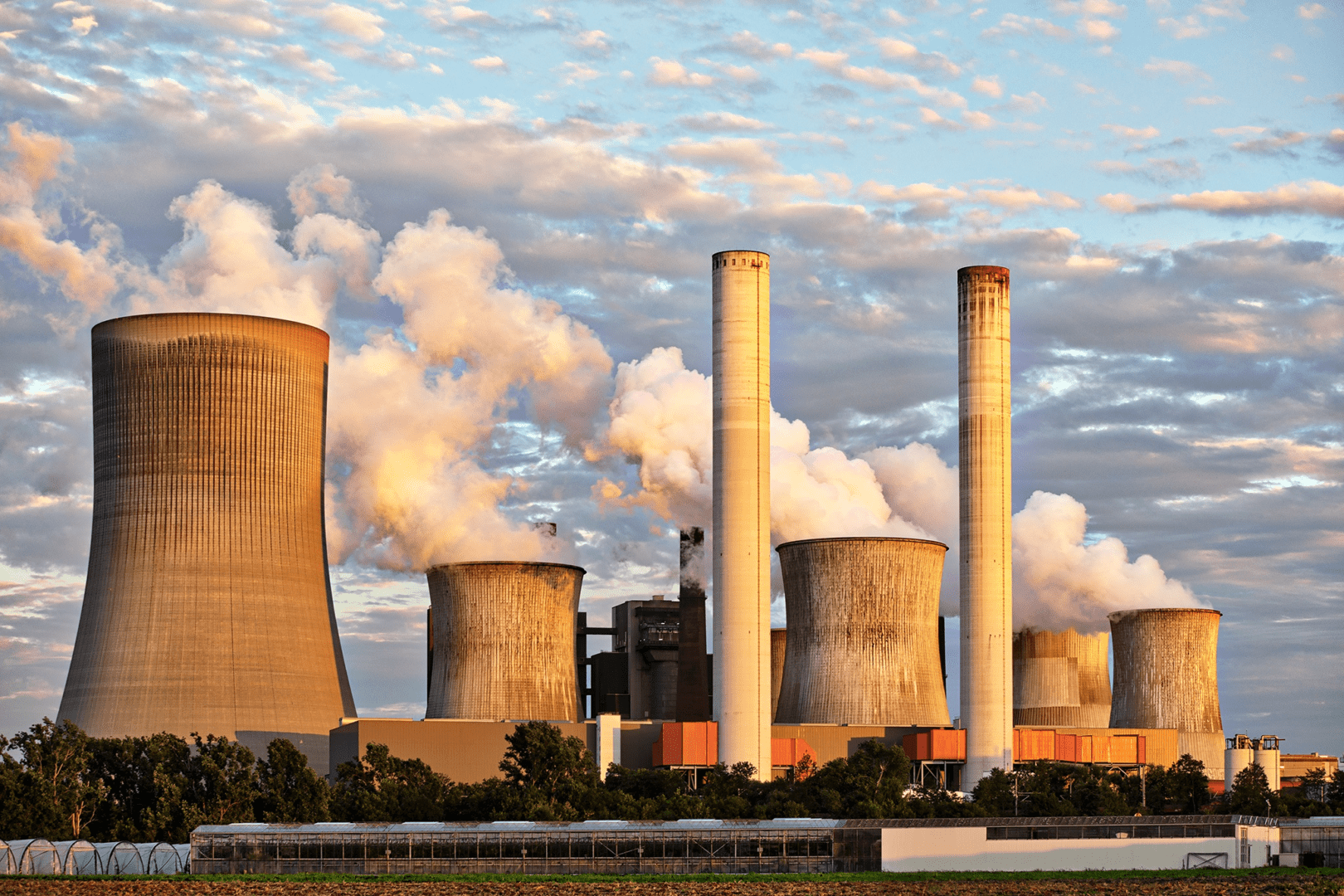

Read MoreNuclear Power: A Catalyst for AI Advancement in the United States

Abstract The rapid growth of artificial intelligence (AI) is driving an unprecedented demand for energy. This article explores the critical role of nuclear power in supporting AI development and infrastructure in the United States. It analyzes the energy-intensive nature of AI, the benefits of nuclear power as a reliable energy source, environmental considerations, economic impacts, […]

Read MoreExpert Advice for Investing in Global Equities: Why Hemisphere Investments is Your Best Partner

Introduction In today’s interconnected world, investing in Global Equities offers a wealth of opportunities for security price appreciation and portfolio diversification. However, navigating the complexities of international markets can be daunting without the right guidance. That’s where Hemisphere Investment Management (HIM) comes in. As a leading expert in global equity investment management, we provide our […]

Read MoreReal Interest Rates

Q4 2024 Market Commentary On 9/18/2024 the Federal Reserve lowered its target range for the federal funds rate by half a percentage point. The current target rate range is now 4.75% to 5%. This was the first rate reduction since March 22, 2023. The federal funds rate is the interest rate banks charge each other […]

Read MoreThe Role of Emerging Market Bonds in a Core-Plus Bond Strategy

Introduction In today’s complex global economy, investors are constantly seeking opportunities to enhance returns and diversify their portfolios . One asset class that continues to have bright prospects is emerging market bonds. These bonds, issued by governments and corporations in developing economies, offer unique opportunities for potential higher returns, and can be an effective component […]

Read MoreNavigating Volatility: How Hemispheres’ Investment Management Strategies Protect and Grow Your Wealth in Uncertain Markets

Understanding Market Volatility Market volatility, often characterized by rapid and unpredictable price fluctuations, is an inherent feature of the financial markets. This volatility can create both opportunities and challenges for investors. Therefore, it is essential to understand the nature and potential impact of volatility on investment portfolios. Why is Volatility a Concern? Volatility can lead […]

Read More