Hemispheres Investment Management offers a Domestic-Plus Equities Strategy. The “Core” portion of the portfolio consists of a highly diversified portfolio such as found in the Russell 3000 Index. The index is part of the FTSE Russell Group and is the basis for both the Russell large-cap Russell 1000 index and the small-cap Russell 2000 Index. The “Plus” component of the portfolio represents strategic allocations that Hemispheres views as offering compelling potential investment returns. Hemispheres is a bottoms-up value manager. When attractive valuations are present, the portfolio may include an allocation of international and emerging market equities. Excess returns can be earned as the discounted stocks re-rate to their fair market value.

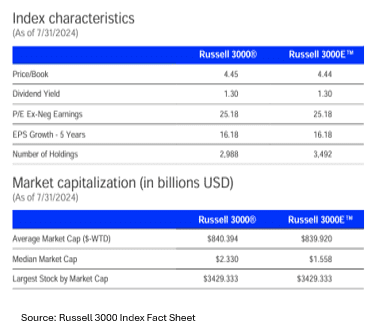

Russell 3000 Index Characteristics

- Based on the Russell 3000 Index Fact sheet, “the Russell 3000® Index measures the performance of the largest 3,000 US companies designed to represent approximately 96% of the investable US equity market. The Russell 3000 Index is constructed to provide a comprehensive, unbiased and stable barometer of the broad U.S. market and is completely reconstituted annually to ensure new and growing equities are included”.[1] The index is a capital weighted index like the S&P 500 and is designed to provide a comprehensive assessment of the US equity markets and sectors.

- The Russell 3000 provides broader exposure to the domestic market than the S&P 500, which provides 80% exposure to U.S. stocks. The Nasdaq Composite Index contains over 3,000 securities but heavily weights the technology sector.

The Russell 3000 Index Fact sheet provides the following information about the Index as of 7/31/2024:

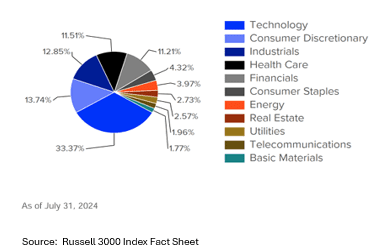

Sector Composition

Limitations Investing in the Russell 3000 Index

- To invest in the Russell 3000 index, there are many ETFs that contain the components and therefore mimic the performance of the index. The index itself is not directly investable.

- The index does not contain any stocks from outside the U.S.

- Because the index is capital weighted, large-cap stock performance accounts for most of the index returns.

- The index is updated quarterly or annually.

Hemispheres Domestic-Plus Equities Strategy

The Domestic-Plus Equities Strategy is heavily weighted toward the domestic equities market. However, international developed and emerging market equities can provide attractive, opportunistic investment alternatives.

- The US economy is the primary driver of growth in the developed world. In mid-year 2024 however, the IMF further reported that “Many emerging market and developing economies have fared better than expected thanks in part to improved terms of trade for some, proactive monetary policy, and a healthy build-up of external buffers.”[2]

- Demographic trends in emerging markets differ from developed nations where population growth is in decline. This feature adds to the attraction of investing in the asset class.

- Kent Smetters, professor of business economics at the Wharton School of the University of Pennsylvania and a proponent of passive index investing, observes that value exists in emerging markets. He wrote: “But in certain niche markets, like emerging markets …where assets are less liquid and fewer people are watching, it is possible for an active manager to spot diamonds in the rough.”[3]

- Further advantages in respect to Emerging Market Investment include low correlations to domestic markets. Low correlation means that there are significant risk reduction opportunities through diversification.

Risk Management

Risk management practices are as important as the expected return garnered through specific assets. The Domestic-Plus Equities Strategy manages risk in multiple ways, all of which include weighting limits.

By Asset Class

Hemispheres allocates capital between U.S., International and Emerging Markets to provide risk reduction through diversification.

By Country

While the Domestic-Plus Equities product is heavily weighted toward domestic equities, Hemispheres Investment Management can invest in undervalued, under-analyzed countries with favorable economic, political, monetary and regulatory trends and practices.

By Sector

Hemispheres assesses sector fundamentals, outlook and valuation to determine sector weighting.

By Security

Sound financial fundamentals and compelling valuation determine position size. Hemispheres assesses intrinsic value utilizing quantitative metrics such as price/book value ratios, dividend yield and enterprise value to sales. Qualitative factors include asset quality, operating cost structure, cash flow generation, debt positions, outstanding products, competitive position and management quality. We believe that the higher the stock price is relative to its intrinsic value, the higher the risk. When we feel that valuations are nearing full value, we begin to trim positions.

Performance

| Domestic – Plus | Russell 3000 | |

| 10/31/2022 – 12/31/2022 | 2.05% | -0.95% |

| 12/31/2022 – 12/31/2023 | 25.90% | 25.92% |

| 12/31/2023 – 06/30/2024 | 7.66% | 13.56% |

Conclusion

Adding an allocation of select domestic, international and emerging market equities can enhance returns while diversifying risk. An experienced advisor can assist you in navigating the geopolitical, regulatory, economic and market risks associated with international and emerging market investment. Particularly in emerging market investment, diversification benefits can reduce portfolio risk.

Hemispheres Investment Management’s team of seasoned professionals have a 35-year track record of managing successful equities investment strategies, including deep proficiency investing in US, international developed and emerging markets. Hemispheres can assist you in diversifying and enhancing your portfolio returns.

Please contact Hemispheres Investment Management for a free consultation. We provide guidance and strategies to assist you in optimizing your investment portfolio and helping you achieve your investment goals. Book a meeting.

[1] US3000USD_20240731 (2).pdf

[2] https://home.treasury.gov/system/files/136/June-2024-FX-Report.pdf

[3] https://executiveeducation.wharton.upenn.edu/thought-leadership/wharton-wealth-management-initiative/wmi-thought-leadership/active-vs-passive-investing-which-approach-offers-better-returns