Company Profile

Archer-Daniels Midland is an industry leading buyer, processor and trader of oil seeds, corn, wheat, and other agricultural commodities. The firm is a distributor of crops from farmers to food, feed and energy buyers. ADM also transports, stores, and/or processes the crops around the globe. Over recent years, ADM has grown the nutrition business through acquisitions. The nutrition segment provides the company with larger operating margins and growth versus the commodity trading business.

Event resulting in stock sell-off

ADM’s share price dropped 21% on Monday, January 21 after the industry leading agribusiness company announced that it placed Vikram Luther, the company’s Chief Financial Officer, on administrative leave pending an investigation into accounting practices in the company’s Nutrition division. The internal investigation is in response to a document request by the Securities and Exchange Commission. Specifically, the document request related to questions regarding accounting methodology surrounding inter-segment sales. In connection with the announcement, ADM delayed the release of fourth quarter and 2023 annual earnings. The company withdrew its forward-looking guidance for the Nutrition Division. The Nutrition Division contributed approximately 8% of total revenues and 11% of profits in fiscal year 2022. Operating profit for the larger business segments for Q4 and FYE2023 are expected to be in line with prior estimates.

At least one individual investor filed a proposed class action lawsuit. The basis for the suit alleges that executive stock awards were tied to the performance of the nutrition segment which incentivized Luther, ADM President Juan Luciano and former CFO Ray Young to make false statements to investors. Concern that accounting irregularities could be found more broadly throughout ADM led to the January 21st rating action by S&P. S&P changed the company’s debt rating outlook to negative.

Mitigating Factors

The company appointed an interim CFO to investigate and resolve any questions regarding accounting practices at the firm. The CEO concluded that “while it is taking longer to close year-end financial reporting, these inter-segment sales do not materially affect our overall results.” The company declared a cash dividend of $0.50 per share, in line with the company’s dividend growth commitment and maintaining a historic record of payment that it has paid for more than 92 years.

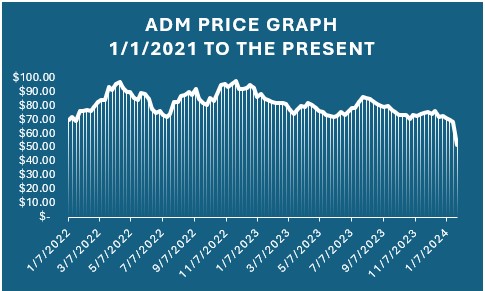

As with any commodity trading business, ADM profits are highly dependent on the spread that the company can generate. The spread is the difference between the price it buys crops from farmers and the price it sells products to customers. ADM profitability increases when crop prices rise and with increased crop price volatility. In 2022 for example, ADM benefited from the fear of crop scarcity and higher risk of transportation disruption associated with the onset of the Russian-Ukraine war. These risks drove crop prices up and ADM’s stock price in 2022 increased accordingly. Crop prices normalized in 2023, and as expected, the company’s margins and stock price dropped in step. Between the normalization of commodity margins and recent accounting issues, ADM stock has declined 43% since September 2022.

Value Identification

Hemispheres Investment Manager is a value-oriented investor, meaning that we invest in industry leading companies when we see an opportunity to provide a superior return for our investors. Hemispheres Investment Management feels ADM’s stock sell off is overdone, presenting a buying opportunity for the following reasons:

- ADM is an industry leading company in the agriculture business sector and has a global network of processing, storage and transportation assets that give it the benefit of scale versus regional competitors. Additionally, because of global operations, ADM benefits from arbitrage opportunities. It can buy from regions with lower prices and sell into more lucrative markets.

- As a processor of soybeans, a key ingredient in animal feed, ADM is benefiting from sales into the emerging markets as these economies are trending toward higher meat consumption.

- The global nutrition business is growing and enjoys higher margins than the commodity trading segment of ADM’s business. Furthermore, the business makes strategic sense in ADM’s portfolio of business segments.

- ADM engages in the ethanol business and in 2021 entered a deal with Gevo, a biofuel company. The current federal government goal is to provide 36-billion-gallons a year in clean jet fuel. On December 15, 2023, the federal government outlined new rules that should give a boost to agriculture companies and refiners that are planning to turn plants and animal fats into green jet fuel. While ADM’s production probably won’t start for a few years, this also is a higher margin business with federal government subsidies.

- The company is an industry leading and knowledgeable participant in the agricultural commodity trading business.

- The company has a large, well-managed balance sheet and healthy cash flow.

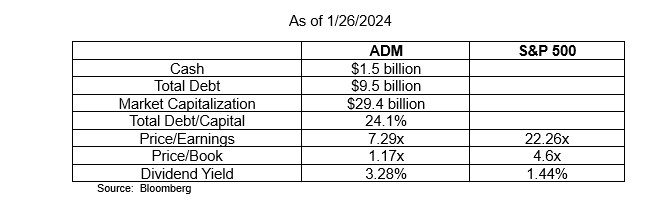

- Valuations are inexpensive as shown below:

Please feel free to contact us at any time with questions or comments that you might have. Book a meeting

Disclosures: This is not a recommendation to buy or sell the security and is an example of Hemispheres Investment Management’s research.

Consult your financial advisor on the appropriateness of holding ADM in your account(s).

Rebecca Holden, CFA

818.970.1197

Michael Hart, CFA

310.993.1886