During 2023 the major U.S. and Global Equities indices made strong advances. The Nasdaq composite index rose 43.1%, the QQQ, as a proxy for the Nasdaq 100, earned 57.4% and the S&P 500 earned returns of 23.8% for the year ended 12/29/2023.

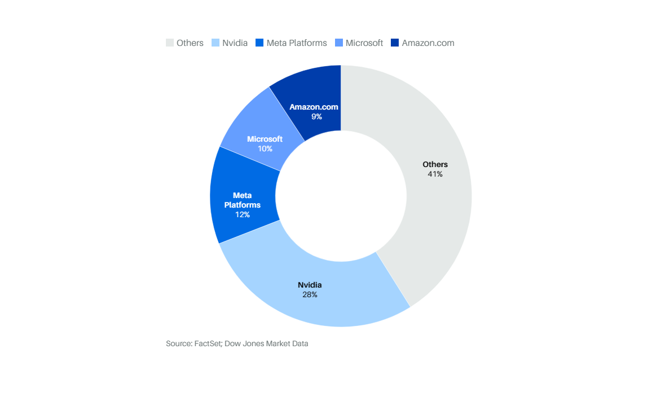

Evaluating the returns for the indices since the beginning of 2023 and including year to date numbers demonstrates a significant market concentration. The “magnificent 7” stocks (Microsoft, Apple, Amazon, Nvidia, Meta, Tesla and Alphabet), make up 38.89% of the QQQ and 29.17% of the S&P 500 as of 2/26/2024. These stocks engage in development of artificial intelligence (AI) technology. Nvidia’s stock price between the beginning of 2023 and the close of 2/25/2024 rose 430.72%. Thus far in 2024, Nvidia has contributed 28% of the overall S&P 500 gains.

An article in Barron’s provided the relative contribution to overall market performance by the top four stocks year to date. The top four stocks contributed 59% of the total index return in 2024 to date! The S&P’s other 496 stocks contributed 41% of the total index return.[1] Other AI sector companies are riding the wave of rapid price appreciation leading us to ask whether given the level of market concentration risk, are in a bubble?

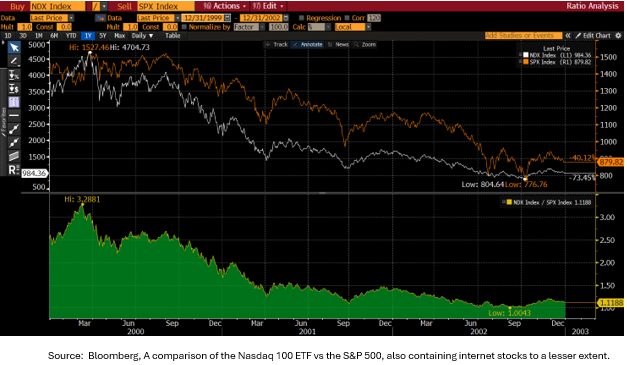

This level of performance and market concentration risk is reminiscent of the Nasdaq 100 returns in 1995 – 2000 during what became known as the “tech bubble.” During that period there was great enthusiasm for the rapid adoption of the internet. The hype surrounding internet-related businesses fueled speculative investments both on the part of venture capitalists and subsequently by investors through a large number of Initial Public Offerings. The stock prices of these entities rose well beyond the intrinsic value, resulting in market concentration risk within the sector. A significant number of these businesses were not profitable and had poor business plans. In 2000, many of the Dot-com startups ran out of cash, were not profitable and lost access to further funding resulting in ultimate failure. Between January 1, 2000, and December 31, 2002, the Nasdaq 100 dropped 73.45%.

Artificial Intelligence Firms in Today’s markets

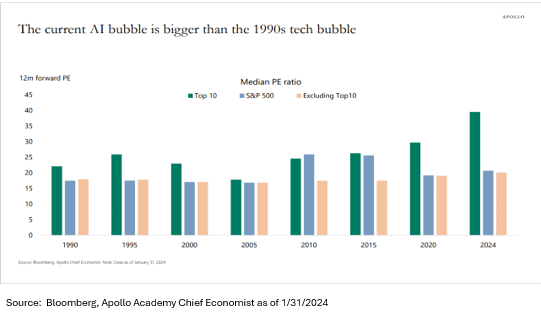

As the chart below demonstrates, on a 12 month forward PE basis, valuations for AI stocks are higher now than for the internet related stocks in the 1990s.

While the magnificent 7 stocks are profitable and do have respectable business plans today, these stocks already have high valuations. Any factor in their financial reporting that falls short of investor expectation could result in a potentially sizable sell-off. It appears that many stocks in the Artificial Intelligence space are the subject of speculative trading. Shares of SoundHound AI (SOUN), a provider of Artificial Intelligence-infused voice response systems illustrate our point. SOUN share price rose 20% on Tuesday, Feb 26th, bringing the stock’s two-day rally to 76%.

According to Bloomberg estimates, SoundHound’s Revenue for FYE 2023 of $46.5 million compares to a Net Loss of $82.3 million. By 2026, SoundHound is forecasted to have $139 million in Revenue and a Net Loss of $46.7 million. Despite forecasted annual losses each year through FYE 2026, today the company boasts a market capitalization of $1.6 billion. This level of speculation generally does not end well.

While Hemispheres agrees that artificial intelligence offers potentially life altering technologies, we highlight the speculative environment surrounding AI stocks. Significant risks exist, including increased scrutiny by Governments. Furthermore, many participants lack solid fundamentals. Hemispheres firmly believes in the value of solid fundamentals when adding any security to Hemispheres portfolios.

Conclusion

AI stocks notwithstanding, based upon optimistic economic data, Hemispheres anticipates a broadening of performance on the various indices. The S&P and Nasdaq equal-weighted indices respective performance as of the close on 2/26/2024 is 2.75% and 4.62%. We believe there is significant upside in other sectors with lower risk.

We recognize that individual and institutional investors alike may be new to investing in artificial intelligence. There are complexities and nuances associated with investing in various markets that require expert guidance. Hemispheres Investment Management’s team of seasoned professionals have a 35-year track record of successful investment strategies.

Please contact Hemispheres Investment Management for a free consultation. We offer individualized guidance and strategies that can help you to meet your financial objectives. Book a meeting

Should you have any questions, please feel free to contact us.

[1] What’s Behind the S&P 500’s Spectacular Gains, in 4 Charts – Barron’s (barrons.com) Evie Liu Feb 24, 2024